General Liability Insurance Cost for Small LLCs in Florida

Understanding General Liability Insurance Cost for Small LLCs in Florida

Imagine this: You’re running a small LLC in Florida—a cozy coffee shop in Miami or a freelance consulting firm in Orlando. One day, a customer slips on a wet floor, injures themselves, and decides to sue for medical bills and lost wages. Without protection, that single incident could drain your business savings or even force you to close shop. This is where general liability insurance comes in—it’s the foundational shield for small businesses against everyday risks like accidents, property damage, or advertising injuries.

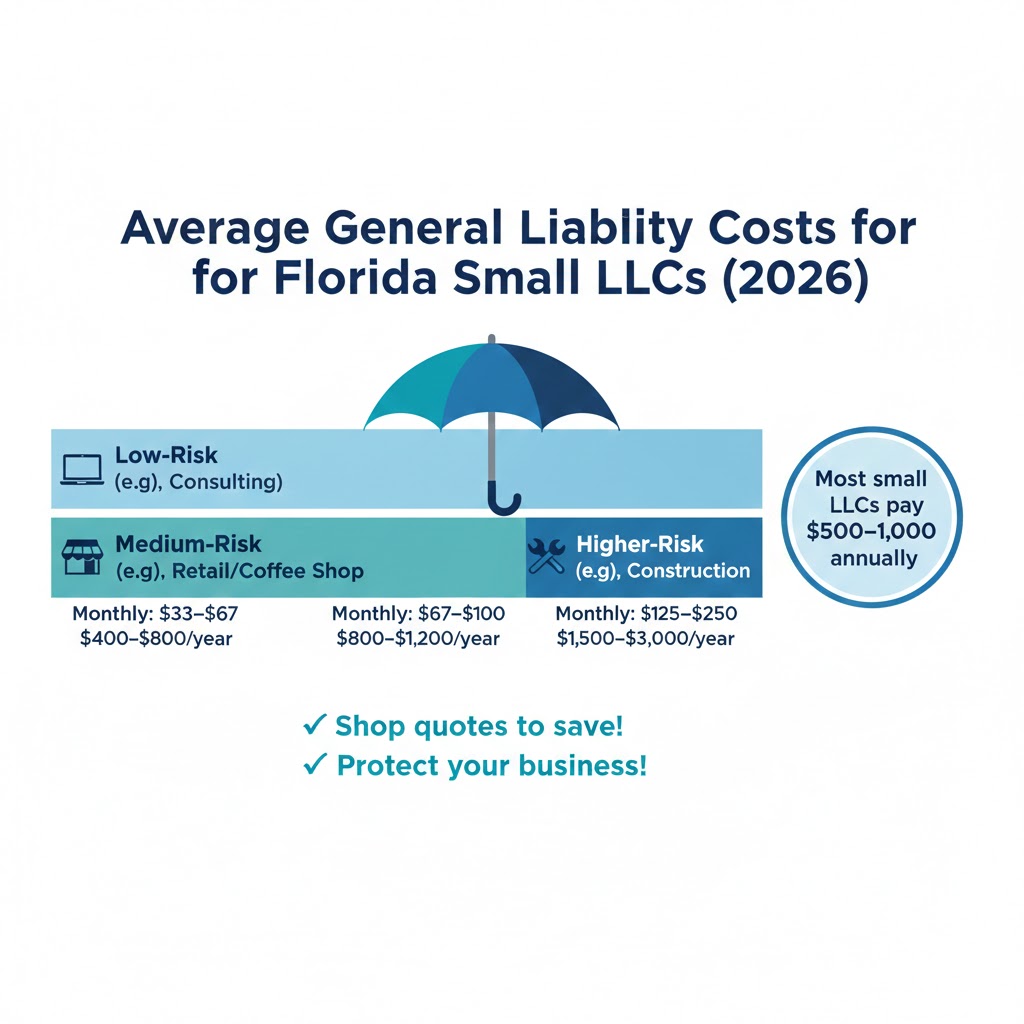

The general liability insurance cost for small LLC in Florida typically ranges from $400 to $1,500 annually, or about $35 to $125 per month, depending on your specific setup. For many low-risk small LLCs, averages hover around $500–$800 per year. These figures make it an accessible yet powerful tool for protecting your hard-earned business in the Sunshine State.

As someone who’s helped countless Florida entrepreneurs navigate insurance (and built tools to simplify the process), I’ve seen firsthand how understanding these costs empowers owners to make smart decisions. In this guide, we’ll break down everything you need to know about general liability insurance for your small LLC—from what drives the price to real-world examples and tips for saving money.

What Is General Liability Insurance and Why Do Small LLCs in Florida Need It?

General liability insurance (often called GL or commercial general liability) protects your business from third-party claims of:

- Bodily injury (e.g., a client trips in your office)

- Property damage (e.g., your equipment damages a client’s venue)

- Personal and advertising injury (e.g., libel or copyright infringement in marketing)

It covers legal fees, settlements, and medical payments—costs that can easily reach tens of thousands without coverage.

Florida does not require general liability insurance by state law for most LLCs. However, it’s practically essential because:

- Commercial leases almost always demand proof of coverage (typically $1 million per occurrence/$2 million aggregate).

- Clients, especially larger ones or government contracts, require it.

- Local counties or cities may mandate it for business licenses or permits.

- Certain professions (like general contractors) need it for licensing.

Without it, your LLC’s limited liability protection might not fully shield personal assets in severe cases, and one lawsuit could jeopardize everything.

Related: Explore more on overall business insurance options to see how GL fits into a complete plan.

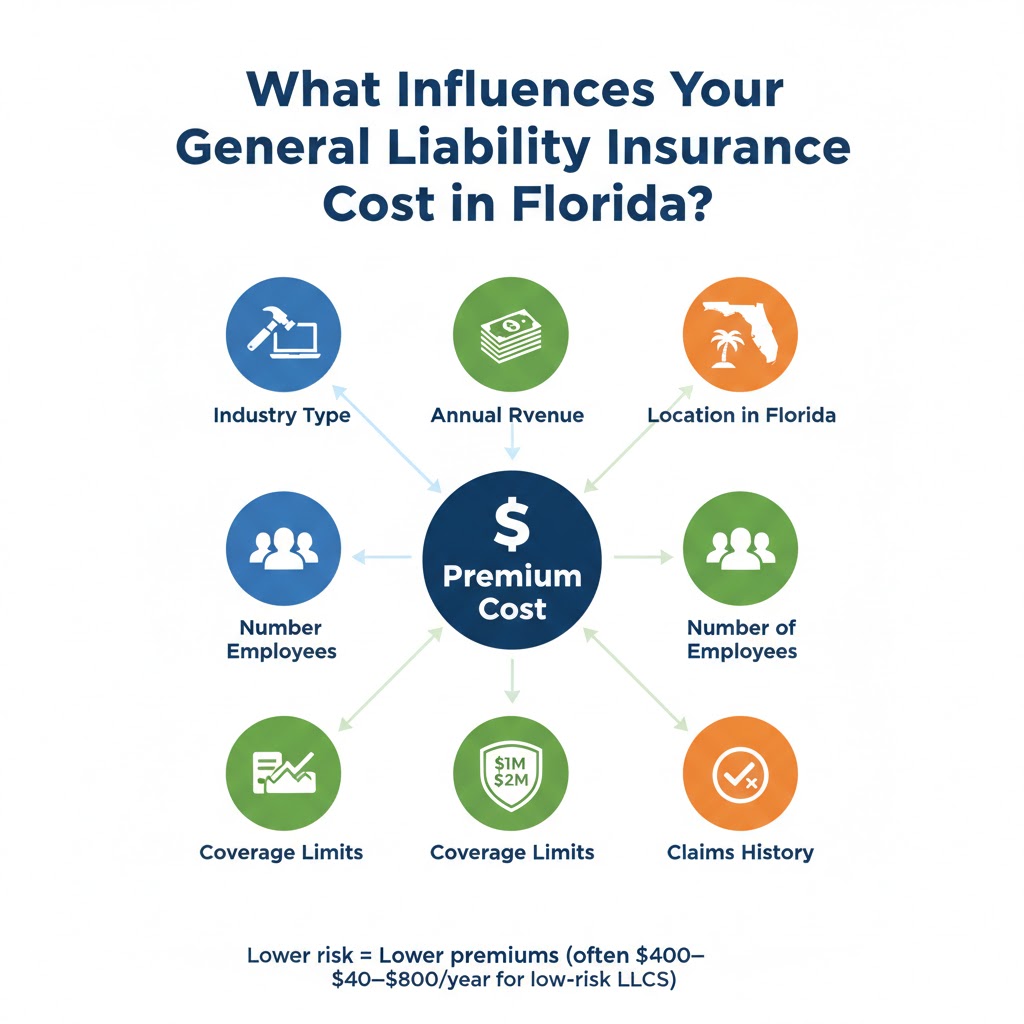

Key Factors That Influence General Liability Insurance Cost for Small LLCs in Florida

Insurers calculate your premium based on risk exposure. Here’s what impacts the general liability insurance cost for small LLC in Florida the most:

- Industry and Risk Level: Low-risk offices (e.g., consulting) pay less than high-risk fields (e.g., construction or pressure washing).

- Annual Revenue and Payroll: Higher gross sales or employee count increases exposure, raising premiums.

- Location: Urban areas like Miami or Tampa have higher litigation rates; coastal zones add weather-related risks.

- Coverage Limits and Deductibles: Standard $1M/$2M limits are common; higher limits cost more, while higher deductibles lower premiums.

- Claims History: A clean record earns discounts; past claims can increase rates.

- Business Size and Foot Traffic: More employees or customer visits mean more potential incidents.

These factors explain why costs vary so widely—even among similar LLCs.

Average Costs and Real Statistics for Florida Small Businesses

Recent data (2025–2026) shows:

- Small businesses in Florida pay an average of $49–$89 per month for general liability.

- Low-risk LLCs (e.g., consulting or freelance) often see $400–$800 annually.

- Higher-risk operations can reach $1,000–$3,000+ per year.

- About 40% of small businesses pay between $30–$60 monthly.

Statistics highlight the value: Customer injury claims average $35,000, while reputational harm can hit $50,000. Slip-and-fall incidents alone account for 10% of claims at around $20,000 each.

Florida’s improving insurance market (thanks to recent tort reforms) has lowered rates for many in 2024–2025, making now a great time to shop.

How General Liability Premiums Are Calculated: Step-by-Step Explanation

Insurers use a rating formula to estimate your risk. While exact algorithms vary by carrier, the core logic is:

- Base Rate by Class Code: Each industry has a classification code with a base rate per $1,000 of exposure.

- Exposure Base: Often gross receipts (revenue) or payroll.

- Adjustments: For location, claims history, limits, etc.

- Final Premium = (Base Rate × Exposure / 1,000) × Modifications

Simple Example Formula (illustrative, not exact):

Annual Premium ≈ (Industry Rate per $1,000 Revenue) × (Annual Revenue / 1,000) × (Location/Experience Modifier)

- Industry Rate: $0.50–$5+ per $1,000 (low for offices, high for contractors).

- Modifier: 0.8–1.5 (discounts for safety/clean history).

This matches real underwriting—revenue drives most small LLC costs.

Try plugging in your numbers mentally, or better yet, get quotes to see variations.

Practical Scenarios: 3 Step-by-Step Cost Examples

Let’s apply this to realistic Florida small LLCs.

Example 1: Low-Risk Consulting LLC (Home-Based Freelancer)

- Revenue: $100,000/year

- No employees, office-based/remote

- Location: Orlando suburbs

- Limits: $1M/$2M

Estimated Calculation:

- Base rate: ~$4–$6 per $1,000 revenue

- Premium: ~$400–$600/year ($33–$50/month)

Why relevant: Many Florida freelancers skip insurance thinking “I’m low-risk,” but client contracts often require it. At this price, it’s affordable peace of mind.

Example 2: Retail Coffee Shop LLC

- Revenue: $300,000/year

- 5 employees, public foot traffic

- Location: Miami

- Limits: $1M/$2M

Estimated Calculation:

- Base rate: ~$8–$12 per $1,000 (higher due to slips/public exposure)

- Premium: ~$800–$1,200/year ($67–$100/month)

Relevant because slip-and-falls are common in hospitality. Recent stats show these claims average $20,000–$35,000—coverage prevents bankruptcy.

Example 3: Small Construction LLC (Handyman Services)

- Revenue: $200,000/year

- 2 employees

- Location: Tampa

- Limits: $1M/$2M

Estimated Calculation:

- Base rate: ~$15–$25 per $1,000 (high physical risk)

- Premium: ~$1,500–$3,000/year ($125–$250/month)

Why it matters: Construction faces property damage risks; Florida’s weather amplifies issues. Many leases/clients demand proof.

Test different scenarios yourself—adjust revenue or add employees to see how costs shift.

Top Providers for Small LLCs in Florida

Strong options include:

- The Hartford: Often cheapest (~$89/month average), excellent for diverse industries.

- NEXT Insurance: Digital-friendly, great for quick online quotes (~$112/month).

- Nationwide or Hiscox: Solid for tailored small business coverage.

Compare 3–5 quotes annually—Florida’s market improvements mean savings.

For related needs, check professional liability for consultants or workers’ comp considerations.

Tips to Lower Your General Liability Costs

- Bundle into a Business Owner’s Policy (BOP) for 15–30% savings.

- Pay annually for 8–10% discounts.

- Implement safety measures (e.g., training) for credits.

- Choose higher deductibles if cash flow allows.

- Maintain a clean claims record.

FAQs About General Liability Insurance for Small LLCs in Florida

1. Is general liability insurance required for LLCs in Florida?

No statewide mandate, but leases, clients, and local rules often require it. Workers’ comp is required for 4+ employees (1+ in construction).

2. How much should a small Florida LLC budget for general liability?

Start with $500–$1,000 annually. Get quotes based on your revenue/industry for accuracy.

3. Can I get coverage if my LLC has past claims?

Yes, but premiums may rise. Shop specialty carriers if needed.

Extra tip: Review annually—Florida’s reforms are lowering rates.

Conclusion: Protect Your Florida LLC Without Overpaying

The general liability insurance cost for small LLC in Florida is surprisingly affordable—often $500–$1,000 yearly—yet it safeguards against devastating claims that average $20,000–$50,000. By understanding factors like industry, revenue, and location, you can secure the right coverage at the best rate.

Don’t leave your business exposed. Get multiple quotes today, test scenarios with different limits, and build a plan that grows with you. Your LLC deserves this essential protection—start exploring options now for true peace of mind.