Professional Liability Claims Process for Accountants

Understanding the Professional Liability Claims Process for Accountants: Examples and Insights

Imagine this: You’ve trusted your accountant for years to handle your business taxes accurately. One day, you receive a notice from the IRS about substantial penalties due to missed deductions and filing errors. Suddenly, you’re facing thousands in unexpected costs, and you start wondering if your accountant is responsible. This isn’t uncommon—professional liability claims process for accountants often begins in scenarios just like this, where a perceived error leads to financial harm.

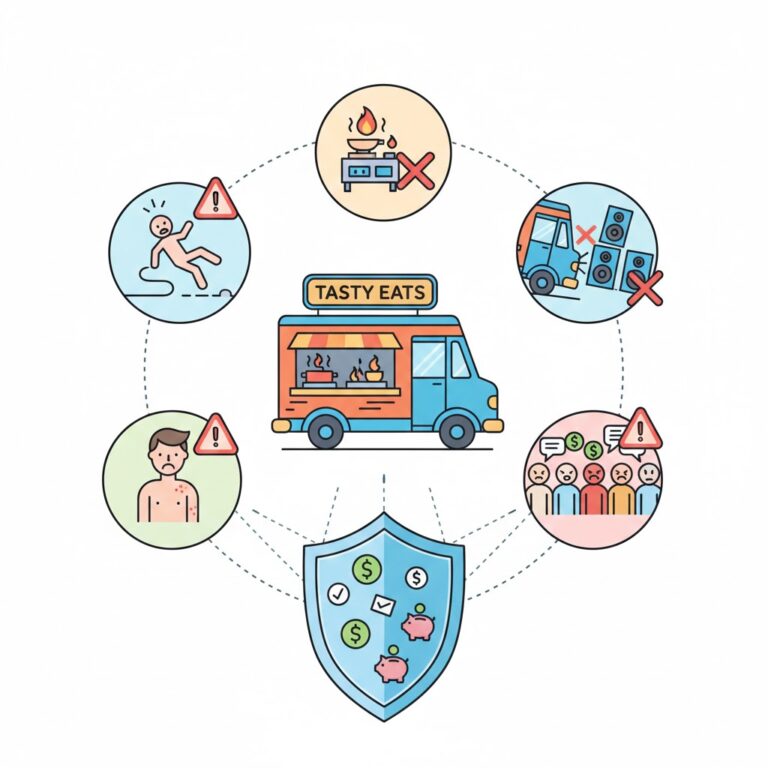

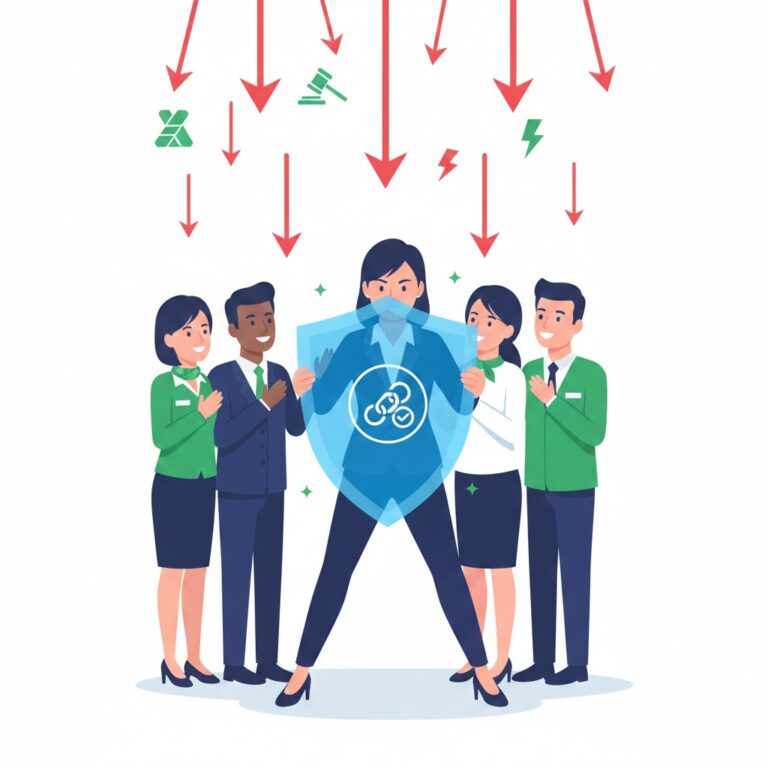

As an expert in accounting risk management with years of experience advising CPAs and firms on liability issues, I’ve seen how these claims can disrupt practices. Professional liability insurance, also known as errors and omissions (E&O) insurance or accountants malpractice insurance, plays a critical role here. It protects accountants from allegations of negligence, mistakes, or omissions in professional services. In this comprehensive guide, we’ll dive deep into the claims process, real-world examples, and practical steps to navigate or prevent them. Whether you’re an accountant preparing for risks or a client considering a claim, understanding this process empowers better decisions.

What Is Professional Liability for Accountants?

Professional liability for accountants arises when a client alleges that your services caused them financial loss due to negligence, errors, or failure to meet professional standards. Unlike general liability, which covers bodily injury or property damage, this focuses on professional advice and services like tax preparation, auditing, bookkeeping, and financial consulting.

Key related terms include:

- Errors and omissions (E&O) insurance: The policy that defends and covers settlements for covered claims.

- Claims-made policy: Most accountants’ professional liability policies are “claims-made,” meaning coverage applies when the claim is filed and reported during the policy period, not when the error occurred.

- Negligence: Failure to exercise the care a reasonably competent accountant would under similar circumstances, often benchmarked against GAAP (Generally Accepted Accounting Principles) or GAAS (Generally Accepted Auditing Standards).

These claims can come from direct clients or, in some cases, third parties like investors relying on your work. Statistics show tax-related errors are among the most frequent triggers, with filing mistakes now leading over incorrect advice in many reports.

Common Types of Professional Liability Claims Against Accountants

Accountants face a range of allegations. Here are the most common, based on industry trends:

- Tax preparation errors: Missed deadlines, incorrect calculations, or overlooked deductions leading to IRS penalties and interest.

- Audit failures: Overlooking material misstatements or fraud in financial reviews.

- Incorrect financial advice: Recommending strategies that result in losses, like poor investment or tax planning.

- Bookkeeping mistakes: Wrong entries causing inaccurate financial statements.

- Breach of contract: Failing to deliver agreed services on time or scope.

- Failure to detect embezzlement: In audits, missing red flags of internal fraud.

Even frivolous claims—where no error occurred but a dissatisfied client sues—can arise, emphasizing why defense costs coverage is vital.

The Professional Liability Claims Process for Accountants: Step-by-Step

Navigating a claim can feel overwhelming, but knowing the steps helps. The process typically unfolds like this for the accountant (insured party):

Step 1: Notification of a Potential Claim

- A client sends a demand letter, files a lawsuit, or verbally threatens action.

- Immediate action: Report it to your insurer right away. Delays can jeopardize coverage under claims-made policies.

- Many insurers offer “pre-claim assistance” for potential issues, helping resolve disputes early.

Step 2: Insurer Assignment and Investigation

- Your claim is assigned to a specialist in accountants’ professional liability.

- The insurer investigates: Reviews engagement letters, work papers, communications, and policy terms.

- They determine if it’s covered (e.g., arose from professional services, within retroactive date).

Step 3: Defense Counsel Appointment

- The insurer selects and pays for experienced defense attorneys specializing in accountants’ cases.

- Criteria: Track record in similar matters, jurisdiction knowledge, and communication skills.

- You can’t usually choose your own lawyer unless the policy allows it.

Step 4: Resolution Phase

- Negotiation/Mediation: Most claims settle out of court to avoid trials.

- Litigation: If needed, the insurer funds defense, potentially up to policy limits.

- Outcomes: Dismissal, settlement (often $50,000–hundreds of thousands), or judgment.

Step 5: Post-Resolution

- Deductibles apply; excess limits may kick in for large claims.

- Lessons learned: Many insurers provide risk management resources post-claim.

The entire process can take months to years, but early reporting and documentation speed it up.

Real-World Examples of Professional Liability Claims for Accountants

To illustrate, here are four detailed, step-by-step examples drawn from common industry scenarios and reported cases. These highlight relevance for small firms, solo practitioners, or larger practices.

Example 1: Tax Preparation Error Leading to Penalties

A contractor hired an accountant for several years to prepare returns and provide limited consulting. The accountant missed key deductions, resulting in underpayment and $716,000 in back taxes plus $170,000 in interest/penalties (similar to a high-profile case involving a prominent attorney).

- Step-by-step:

- Client discovers issue via IRS audit.

- Demands reimbursement for penalties.

- Accountant reports to insurer.

- Investigation confirms error in professional services.

- Settles for significant amount, covered by E&O.

- Relevance: Tax errors are the top claim source. Even honest mistakes trigger liability.

- Lesson: Clear engagement letters defining scope prevent “scope creep” disputes.

Example 2: Disputed Scope of Advice

An accountant prepared returns but allegedly gave broader tax advice the client relied on, causing losses. Client claimed full advisory role; accountant said limited to preparation.

- Step-by-step:

- Business suffers tax issues post-advice.

- Client sues for negligence.

- Insurer defends, highlighting engagement letter.

- Matter settles out of court for $50,000.

- Relevance: Common in consulting hybrids. Clients may interpret casual advice as formal.

- Calculation example: If penalties = $100,000 principal + 8% annual interest over 3 years: Interest = $100,000 × 0.08 × 3 = $24,000. Total claim: $124,000 (plus legal fees).

Example 3: Audit Oversight Missing Fraud

During an audit, accountant fails to detect embezzlement, leading client to rely on flawed statements and suffer losses.

- Step-by-step:

- Fraud discovered later by new auditor.

- Client claims negligence in GAAS compliance.

- Insurer investigates work papers.

- Defense argues reasonable procedures followed; settles to avoid trial.

- Relevance: Audits carry high severity; third parties (e.g., lenders) may also claim.

Example 4: Missed Filing Deadline

Accountant overlooks extension deadline, causing late penalties.

- Step-by-step:

- IRS assesses fines (e.g., 5% per month up to 25%).

- Client files claim.

- Quick settlement as error clear.

- Formula clarification: Late filing penalty ≈ 5% of unpaid taxes per month (max 25%) + interest at federal rate (~5–8%).

These examples show claims often settle to minimize costs, even if defensible.

Preventing Claims: Best Practices for Accountants

While insurance is essential, prevention builds trustworthiness:

- Use detailed engagement letters.

- Document all advice and client approvals.

- Stay current on tax laws.

- Consider related coverages like cyber liability for data breaches.

For broader protection, explore business insurance options or general liability for small businesses.

FAQs About Professional Liability Claims for Accountants

1. How long do I have to report a claim?

Under claims-made policies, report as soon as you’re aware—often in the same policy period. Tail coverage extends reporting for past acts.

2. Does professional liability cover fraudulent claims?

It covers defense costs even for groundless allegations, but not intentional fraud by you.

3. What’s the average cost to resolve a claim?

Varies widely; defense alone can exceed $50,000, with settlements often higher for tax/audit issues.

Extra tip: Test scenarios with your policy—contact your broker to simulate “what if” claims.

Conclusion

The professional liability claims process for accountants—from notification through resolution—protects your practice while ensuring accountability. By understanding common triggers like tax errors or advice disputes, and learning from real examples, you can mitigate risks effectively. Professional liability insurance isn’t just coverage; it’s peace of mind in a high-stakes profession.

If you’re an accountant, review your policy today and consider enhancements. Clients exploring claims should consult professionals. For related needs, check workers’ compensation rates or state-specific rules like general liability costs in Florida.

Stay proactive—your expertise deserves protection.