Workers Comp Insurance Audit Tips for Construction Companies

Workers Comp Insurance Audit Tips for Construction Companies

Imagine wrapping up a busy year on the job site, only to get a notice from your insurance carrier scheduling a workers’ compensation premium audit. Suddenly, you’re digging through files, worried about a surprise bill that could run into tens of thousands of dollars. This scenario plays out for many construction company owners every year. Workers comp insurance audit tips for construction companies can make the difference between a smooth process and a costly headache.

As someone who’s worked closely with contractors on insurance matters for years, I’ve seen how proper preparation turns these audits into routine check-ups rather than financial pitfalls. Workers’ compensation audits are essential because your initial premium is based on estimated payroll and risk classifications. The audit reconciles that estimate with actual figures, ensuring you pay exactly what you owe—no more, no less. For construction firms, where payroll fluctuates with projects, subcontractors come and go, and job duties vary, getting this right is crucial for controlling costs and staying compliant.

In this guide, we’ll dive deep into practical strategies tailored to the construction industry. You’ll learn how audits work, common pitfalls to avoid, and step-by-step preparation tips. By the end, you’ll feel confident heading into your next audit.

Understanding Workers’ Compensation Audits in Construction

A workers’ compensation audit (often called a premium audit) is an annual review conducted by your insurance carrier at the end of your policy term. Its primary goal is to verify that your premium matches your actual exposure based on payroll, employee classifications, and operations.

How Workers’ Comp Premiums Are Calculated

Workers’ comp premiums start with an estimate when you buy the policy. The basic formula is straightforward:

Premium = (Payroll / 100) × Rate × Experience Modifier

- Payroll: Total remuneration (wages, bonuses, etc.), often broken down by classification code.

- Rate: A dollar amount per $100 of payroll, set by the state and the National Council on Compensation Insurance (NCCI) or state-specific bodies. Construction trades like roofing or carpentry have higher rates due to elevated risk.

- Experience Modifier (Mod): A factor based on your claims history—below 1.0 for good records, above for poor ones.

During the audit, the carrier replaces your estimated payroll with actual figures. If actual payroll was higher (e.g., due to overtime or new hires), you owe additional premium. If lower, you get a refund.

In construction, audits often trigger physical or detailed reviews because of high-risk class codes and frequent use of subcontractors.

Types of Audits

- Phone or Mail/Online Audit: Common for smaller premiums; you submit documents remotely.

- Physical Audit: Typical for construction companies with premiums over $10,000–$25,000 (varies by carrier) or complex operations. An auditor visits your office or reviews via video.

- Voluntary Audit: Less common, but useful if you anticipate changes.

Audits usually occur 30–90 days after policy expiration, and non-compliance can lead to penalties or policy cancellation.

Why Construction Companies Face Unique Audit Challenges

Construction is a high-risk industry with variable payroll, seasonal workers, multiple job sites, and heavy reliance on subcontractors. Common issues include:

- Fluctuating payroll from project-based work.

- Misclassification of employees (e.g., putting a roofer under a lower-risk clerical code).

- Uninsured subcontractors leading to added exposure.

- Overtime not properly discounted.

- Divided duties across high- and low-risk tasks without proper records.

Statistics show that many construction firms end up owing additional premiums post-audit, sometimes 20–50% more than estimated, due to these factors.

Essential Workers Comp Insurance Audit Tips for Construction Companies

Preparation is key. Start gathering records quarterly to avoid year-end scrambling.

1. Organize Payroll Records Meticulously

Accurate payroll is the foundation of any audit.

- Separate gross payroll by employee and classification code.

- Break out overtime premiums—most states allow overtime to be charged at the straight-time rate, reducing costs.

- Exclude non-payroll items like bonuses if permissible, but document everything.

Example Calculation: Overtime Discount

Suppose a carpenter earns $40/hour regular and $60/hour overtime, working 40 regular hours and 10 overtime hours weekly.

- Total pay: (40 × $40) + (10 × $60) = $1,600 + $600 = $2,200

- Overtime premium: 10 × $20 = $200

- Auditable payroll: $2,200 – $200 = $2,000 (charged at regular rate)

Over a year, this discount can save thousands for a crew.

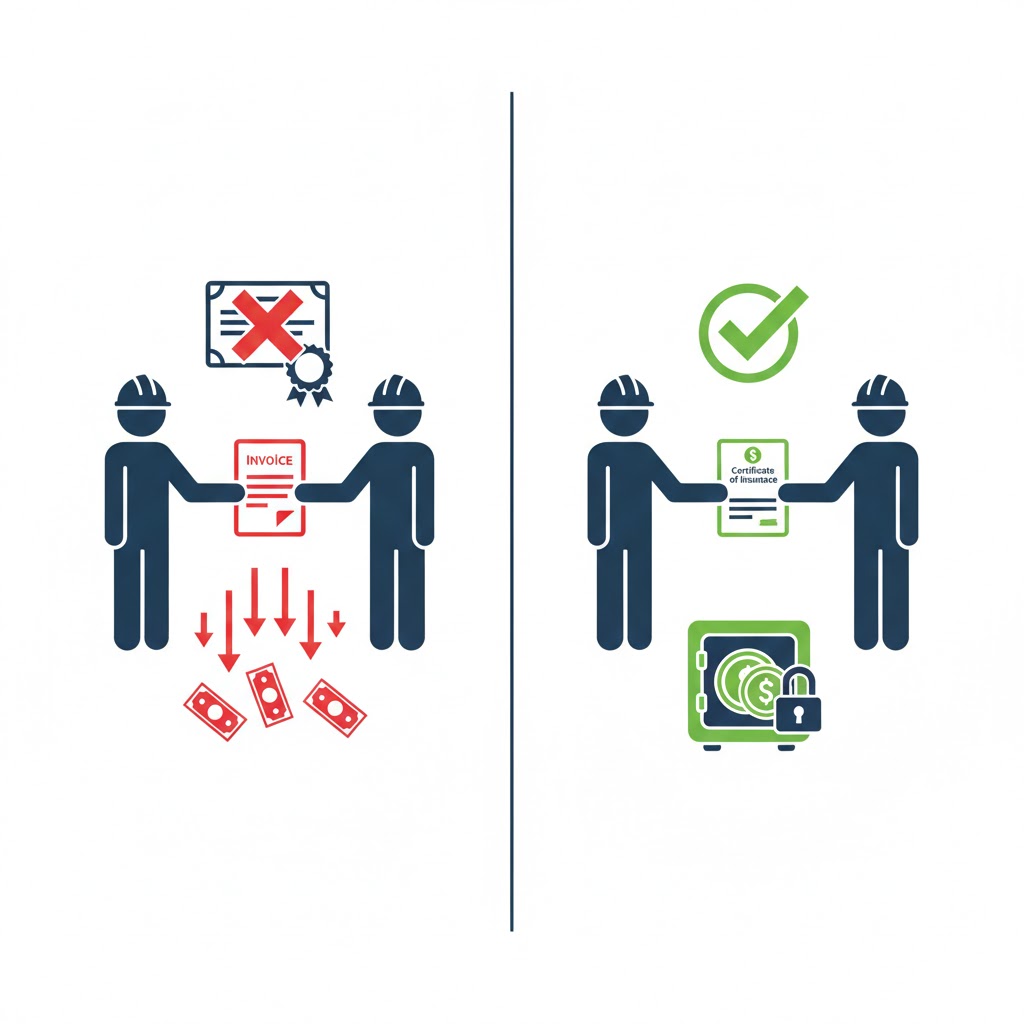

2. Handle Subcontractors Properly—The Biggest Audit Trap

This is where many construction companies get hit hardest. If a subcontractor lacks workers’ comp coverage, payments to them (labor portion) are added to your payroll.

- Require Certificates of Insurance (COIs) from every subcontractor before work starts.

- Verify COIs: Ensure coverage dates overlap your project, limits meet or exceed yours, and New York or other states are listed if applicable.

- Separate labor vs. materials in subcontractor invoices—only labor is auditable.

- File COIs centrally and update annually.

Real-Life Scenario: A general contractor paid $150,000 to uninsured subs for framing. Without COIs, the auditor added the full labor amount (say $100,000 after materials deduction) at the high-risk carpentry rate of $25/$100 payroll. Additional premium: ($100,000 / 100) × $25 = $25,000 owed.

With valid COIs: $0 added.

Tip: Include a clause in subcontractor agreements requiring COI submission and allowing withholding payment until provided.

3. Accurate Employee Classification and Payroll Division

Construction workers often perform multiple tasks (e.g., a laborer does site cleanup and concrete work).

- Use correct NCCI class codes (e.g., 5403 for carpentry vs. 9014 for janitorial).

- If allowed in your state, divide an employee’s payroll across codes based on time records.

Step-by-Step Example: Payroll Division

Employee A spends 60% time on high-risk roofing (code rate $30/$100) and 40% on lower-risk siding ($15/$100). Annual payroll: $80,000.

- Without division: All $80,000 at $30 rate → Premium: $24,000

- With division (supported by timecards): $48,000 at $30 + $32,000 at $15 → $14,400 + $4,800 = $19,200

- Savings: $4,800

Maintain detailed timecards with start/end times, breaks, and signatures.

4. Document Officer Exclusions and Other Adjustments

Corporate officers can often exclude themselves from coverage in many states, reducing payroll.

- File proper exclusion forms upfront.

- Track changes in duties or ownership.

5. Prepare a Comprehensive Audit Checklist

Gather these in advance:

- Payroll summaries and reports (quarterly 941s, state unemployment forms).

- Cash disbursements and 1099s for subs.

- All subcontractor COIs.

- Timecard samples.

- Tax returns (1120S or Schedule C).

- Job descriptions and operation photos (for class code verification).

Conduct your own “mini-audit” quarterly to spot issues early.

Practical Scenario with Statistics: Industry reports indicate that 30–40% of construction audits result in refunds when properly prepared, vs. additional bills for unprepared firms. One mid-sized contractor I worked with saved $18,000 by properly documenting sub COIs and overtime.

Common Mistakes to Avoid During Your Audit

- Missing or invalid subcontractor COIs—leads to massive additions.

- Poor records for divided payroll—defaults to highest rate.

- Misclassifying employees—can trigger back premiums for years.

- Not separating overtime—overpays significantly.

- Ignoring officer exclusions—includes unnecessary payroll.

How to Dispute Audit Findings If Needed

If you disagree:

- Request audit worksheets.

- Provide additional documentation.

- Involve your agent or a specialist.

- Appeal formally if required.

Many disputes succeed with better records.

For more on related insurance needs, check our guides on business insurance, workers’ compensation rates for independent contractors, or general liability insurance.

FAQs About Workers Comp Audits for Construction Companies

What happens if I don’t have COIs for all subcontractors?

The auditor will likely add the labor payments to your payroll, charging premium at your highest class code rate. This can add thousands unexpectedly.

How often are workers’ comp audits required?

Annually for most policies, even if canceled or renewed elsewhere.

Can I get a refund from an audit?

Yes—about 40% of audits result in refunds when actual exposure was lower than estimated.

Extra Tip: Consider pay-as-you-go workers’ comp to minimize audit surprises by basing payments on real-time payroll.

Conclusion

Mastering workers comp insurance audit tips for construction companies boils down to organization, accurate records, and proactive subcontractor management. By implementing these strategies—collecting COIs religiously, tracking payroll precisely, and preparing early—you’ll not only avoid surprise bills but potentially earn refunds and lower future premiums.

Take action today: Review your subcontractor files, update your payroll processes, and run a mock audit on last year’s records. Test different scenarios with your payroll data to see potential savings. Your business—and your bottom line—will thank you.

Explore more resources like our guide on workers’ comp exemptions to build a stronger insurance foundation.