General Liability Insurance for Food Truck Vendors

General Liability Insurance for Food Truck Vendors: Essential Protection for Your Mobile Business

Imagine pulling up to a bustling weekend festival with your food truck loaded with fresh tacos or gourmet grilled cheese. The line is forming, the aroma is drawing crowds, and everything feels perfect—until a customer slips on a spilled drink near your service window, twists their ankle, and ends up needing medical attention. Suddenly, you’re facing medical bills, potential legal fees, and a lawsuit that could jeopardize your hard-earned business. This is where general liability insurance for food truck vendors becomes a lifesaver. It’s not just a policy; it’s peace of mind that lets you focus on serving great food without constant worry about unexpected risks.

Running a food truck is an exciting venture full of freedom and flavor, but it comes with unique challenges. From crowded events to on-the-road operations, mobile food vendors face daily exposures to accidents, injuries, and claims. General liability insurance (often called GL or commercial general liability) is the foundation of protection for most food truck owners, covering third-party bodily injury, property damage, and even product-related issues like foodborne illness. In this comprehensive guide, we’ll break down everything you need to know to make informed decisions and safeguard your business.

Why Food Truck Vendors Need General Liability Insurance

Food trucks operate in dynamic environments—parks, festivals, street corners, and private events—interacting directly with the public. This mobility increases risks compared to traditional restaurants. A single claim can cost thousands, potentially wiping out profits or forcing closure.

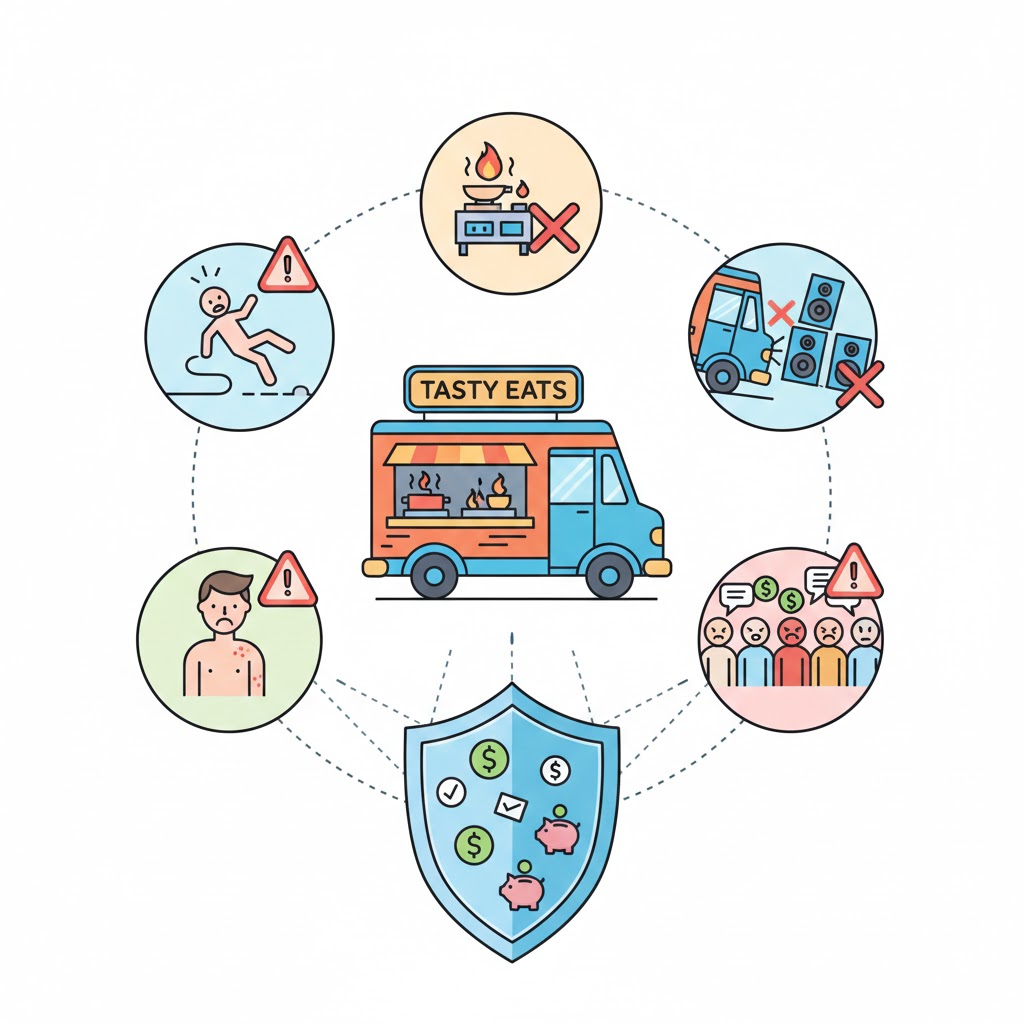

General liability insurance for food truck vendors protects against common claims such as:

- Customer slips and falls near your truck or setup.

- Property damage, like accidentally knocking over event equipment.

- Food-related illnesses (often including product liability for contamination or allergens).

- Advertising injuries, such as slander claims.

Many event organizers, venues, and commissary kitchens require proof of GL coverage (a certificate of insurance) before allowing you to vend. Typical requirements include $1 million per occurrence and $2 million aggregate limits. Without it, prime opportunities could slip away.

Real-world statistics highlight the need: Small food businesses face frequent claims, with average general liability payouts around $6,000–$10,000 for minor incidents. Higher-risk operations, like those frying foods, see elevated premiums due to fire hazards.

Key Differences: General Liability vs. Other Food Truck Coverages

While GL is essential, it’s not comprehensive. Here’s how it compares:

- General Liability (GL): Covers non-vehicle-related third-party claims when parked and operating.

- Commercial Auto Insurance: Required for driving; covers accidents involving your truck (separate from GL).

- Business Owner’s Policy (BOP): Bundles GL with commercial property insurance (for equipment/spoilage) at a discount—often recommended for food trucks.

- Workers’ Compensation: Mandatory in most states if you have employees; covers staff injuries (e.g., burns from grills).

For broader protection, consider adding inland marine for equipment in transit or liquor liability if serving alcohol.

What Does General Liability Insurance Cover for Food Trucks?

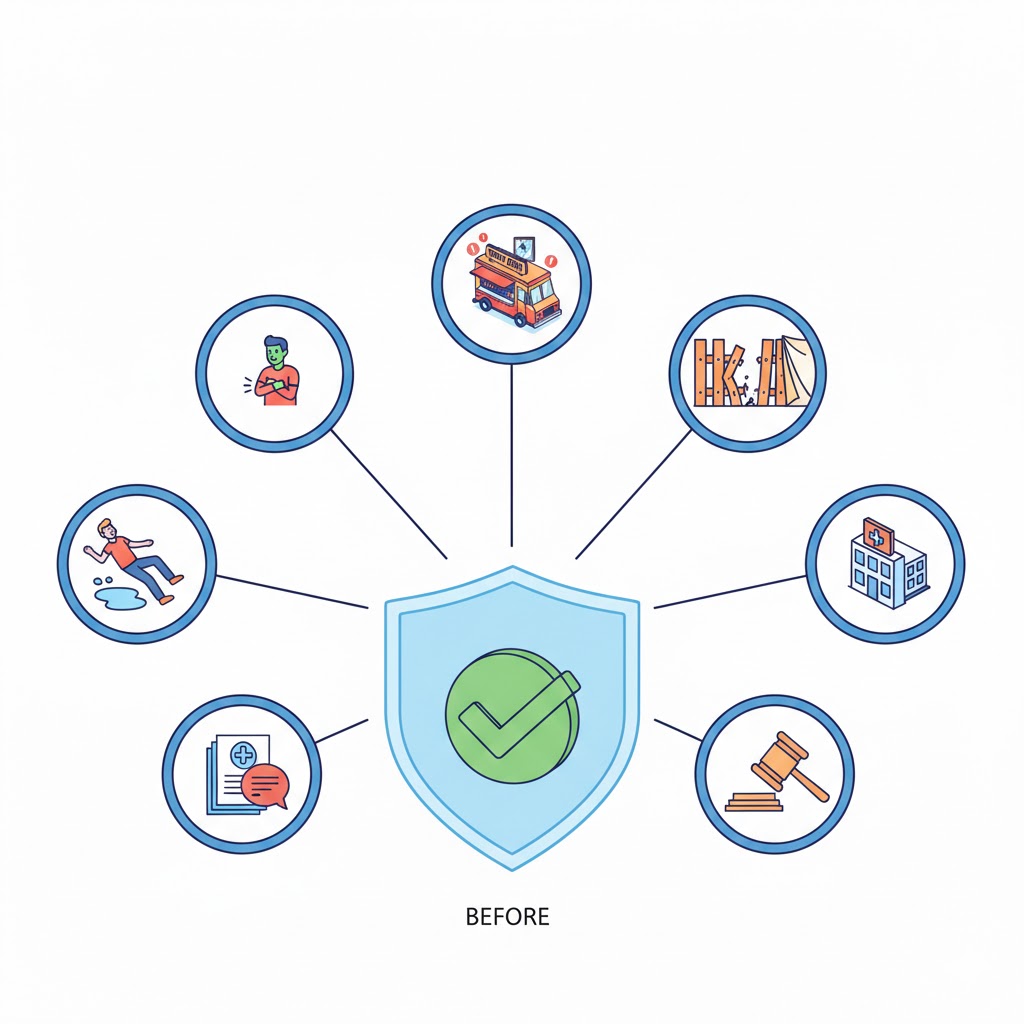

General liability insurance for food truck vendors typically includes:

Bodily Injury

Covers medical expenses, lost wages, and legal fees if a customer or bystander is injured due to your operations.

Property Damage

Pays for repairs if you damage someone else’s property (e.g., venue tents or neighboring vehicles).

Products-Completed Operations

Critical for food trucks—covers claims from food you sell, like food poisoning or unlabeled allergens.

Personal and Advertising Injury

Protects against libel, slander, or copyright issues.

Exclusions often include vehicle accidents (need commercial auto), employee injuries (workers’ comp), or intentional acts.

Real-Life Claim Scenarios for Food Truck Vendors

To illustrate relevance, here are anonymized examples based on common industry claims:

- Slip-and-Fall Incident: A customer tripped over a flower box near a hot dog truck’s window, injuring their knee. GL covered the $99 medical claim, preventing out-of-pocket costs.

- Wind-Related Damage: High winds blew a tent into a neighboring truck, causing dents. The at-fault vendor’s GL paid for repairs after a lawsuit threat.

- Foodborne Illness: A patron claimed illness from undercooked items. Product liability within GL handled medical bills and defense costs.

- Grease Fire Spread: A small fire damaged event property. GL covered venue repairs.

These scenarios show why GL is vital—claims can arise unexpectedly, even with precautions.

Step-by-Step Cost Estimation Example

Food truck insurance costs vary, but here’s a practical breakdown using average 2025–2026 data:

- Base GL for a low-risk truck (prepackaged foods, low revenue): $299–$500 annually ($25–$42/month).

- Higher-risk (frying/grilling, $100K+ revenue): $800–$1,200 annually.

- BOP bundle: $1,000–$2,500 annually (saves 10–20%).

Simple Calculation Formula: Annual Premium ≈ Base Rate + (Revenue Factor × Gross Sales / $100K) + Risk Adjustments

Example: Truck with $150K annual sales, moderate risk (grilling).

- Base: $400

- Revenue adjustment: $150K / $100K = 1.5 × $300 = $450

- Risk add-on (frying): +$200

- Total: $1,050/year (~$88/month)

Test scenarios: Lower sales to $80K drops it to ~$750. Add employees? Factor in workers’ comp (~$940/year average).

Encourage experimenting: Adjust for your menu, location, and limits to see savings.

Factors Affecting General Liability Costs for Food Trucks

Premiums depend on:

- Menu Type: Fried/grilled foods increase fire risk → higher rates.

- Annual Revenue: Higher sales = more exposure.

- Location/Operations: Urban areas or frequent events raise premiums.

- Claims History: Clean record = discounts.

- Coverage Limits: $1M/$2M standard; higher for big events.

Tips to Lower Your Premiums

- Bundle into a BOP for discounts.

- Implement safety protocols (e.g., non-slip mats, allergen labeling).

- Shop multiple providers—specialists like FLIP or NEXT offer rates from $25/month.

- Maintain good records and driver safety.

Related resource: Explore broader business insurance options for bundling ideas.

How to Choose the Right General Liability Policy

- Assess risks: List operations, menu, and venues.

- Get quotes: Compare 3–5 providers.

- Review add-ons: Trailer endorsement if applicable.

- Check requirements: Match event/venue demands.

- Read exclusions carefully.

For seasonal operations, see workers’ compensation for seasonal employees.

If hiring help, understand workers’ comp rates for independent contractors.

For extra protection, consider an umbrella policy.

FAQs About General Liability Insurance for Food Truck Vendors

Is general liability insurance required for food trucks?

Not always by law, but most events, markets, and landlords mandate it (often $1M+ limits). Workers’ comp is required in nearly all states with employees.

How much does it cost on average?

$300–$1,300/year for standalone GL; bundles lower it. Low-risk operations start at $299/year.

Does it cover food trailers?

Standard policies may not when detached—look for trailer endorsements.

Extra tip: Always add venues as “additional insureds” for free on many policies.

Conclusion

General liability insurance for food truck vendors is more than compliance—it’s a smart investment protecting your passion from unpredictable risks. From slips to food claims, it shields your finances so you can thrive on the road.

Summarizing key points: Prioritize GL with product coverage, bundle for savings, and tailor to your menu/location. Test different scenarios with quotes to find your fit.

Ready to protect your truck? Compare options today and explore related guides for full coverage. Your next event awaits—safely insured.