General Liability Certificate for Subcontractors Requirements

General Liability Certificate for Subcontractors Requirements: A Comprehensive Guide

Imagine you’re a general contractor wrapping up bids for a mid-sized commercial renovation project. You’ve lined up reliable subcontractors—an electrician, a plumber, and an HVAC specialist—all ready to start. But just days before mobilization, one sub admits they don’t have current proof of insurance. Suddenly, you’re facing delays, potential contract breaches with the owner, and the nightmare of vicarious liability if something goes wrong on site. This scenario plays out far too often in construction, and it’s exactly why general liability certificate for subcontractors requirements are non-negotiable.

A certificate of liability insurance (often called a COI or ACORD 25 form) serves as verifiable proof that your subcontractors carry adequate general liability insurance. It protects you from financial fallout if a sub’s work causes bodily injury, property damage, or other covered claims. In today’s risk-heavy construction environment, understanding these requirements isn’t optional—it’s essential for protecting your business, complying with contracts, and maintaining professional relationships.

Whether you’re a general contractor vetting subs or a subcontractor preparing to bid, this guide breaks down everything you need to know. We’ll cover what a COI is, common requirements, how to review one properly, real-world examples, and best practices to avoid costly gaps.

What Is a Certificate of General Liability Insurance?

A certificate of liability insurance is a standardized document—typically the ACORD 25 form—that summarizes key details of an insurance policy. It’s issued by the insurer or agent and provides snapshot proof of coverage at the time of issuance. For subcontractors, the focus is usually on commercial general liability (CGL) insurance, which covers third-party claims for bodily injury, property damage, personal injury, and advertising injury arising from business operations.

Importantly, a COI is not the policy itself. It doesn’t grant rights or alter coverage—it’s merely evidence. The disclaimer on every ACORD 25 states: “This certificate is issued as a matter of information only and confers no rights upon the certificate holder.”

Key Sections of an ACORD 25 Form

- Insured: The subcontractor’s legal business name.

- Insurers A-F: The insurance companies providing coverage.

- Coverages: Lists policy types (e.g., commercial general liability), limits, policy numbers, and effective/expiration dates.

- Common GL limits: $1,000,000 per occurrence / $2,000,000 aggregate.

- Description of Operations: Critical area for notes like additional insured status, waiver of subrogation, or project-specific details.

- Certificate Holder: Usually you (the general contractor or owner).

Many contracts also require proof of workers’ compensation, commercial auto, or umbrella/excess liability on the same COI.

For more on overall business insurance, including how GL fits into a broader package.

Why General Contractors Require COIs from Subcontractors

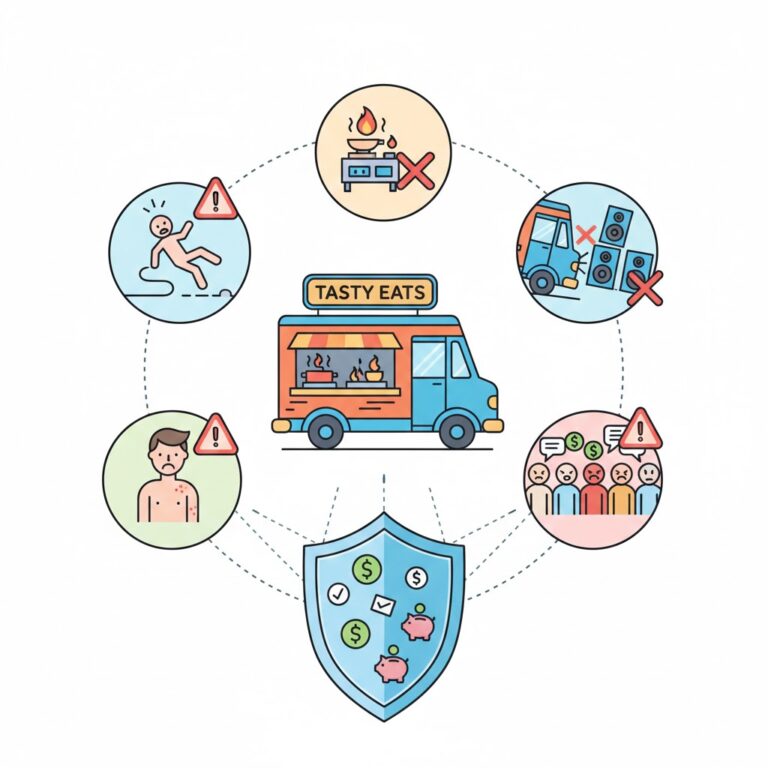

General contractors face vicarious liability for subs’ actions. If an uninsured sub causes damage, your policy—or worse, your personal assets—could be on the hook. Requiring a general liability certificate shifts risk downstream and satisfies upstream obligations (e.g., owner contracts).

Key reasons:

- Risk Transfer: Ensures the sub’s insurance responds first (primary and non-contributory).

- Contract Compliance: Most construction contracts mandate subs carry minimum coverage and provide proof.

- Audit Protection: During GL premium audits, valid COIs from subs prevent you from being charged premiums for their payroll/exposure.

- Professionalism: Insured subs signal reliability, helping you win bigger jobs.

Statistics highlight the stakes: Construction claims average over $40,000, with some exceeding millions. Uninsured subs expose GCs to unnecessary risk.

Common General Liability Certificate Requirements for Subcontractors

Requirements vary by project size, location, trade, and contract, but here’s what you’ll typically see:

Minimum Coverage Limits

- Each Occurrence: $1,000,000 (covers a single claim).

- General Aggregate: $2,000,000 (total limit per policy period).

- Products/Completed Operations Aggregate: $2,000,000 (essential for post-project claims). Higher limits ($2M/$4M) are common for larger or higher-risk projects.

Essential Endorsements

These modify the policy and must be noted (or attached) to the COI:

- Additional Insured: Names the GC (and often owner) on the sub’s policy. Common forms:

- CG 20 10 (ongoing operations).

- CG 20 37 (completed operations).

- Blanket endorsements (automatic for anyone required by written contract).

- Primary and Non-Contributory: Sub’s coverage pays first, before yours.

- Waiver of Subrogation: Insurer waives rights to sue you for recovery.

Other Frequent Requirements

- No major exclusions (e.g., residential work, height, or subsidence).

- Ongoing and completed operations coverage.

- 30-day notice of cancellation to certificate holder.

For high-risk trades like roofing or excavation, umbrella/excess liability ($1M+) is often added.

Check related guides like workers’ compensation rates for independent contractors for combined requirements.

How to Properly Review a Subcontractor’s COI

Don’t just file it—verify it. A faulty COI can leave you exposed.

Step-by-Step Review Process

- Confirm Dates: Coverage must span the entire project (including completed operations period).

- Check Limits: Match or exceed contract minimums.

- Verify Endorsements: Look in “Description of Operations” for additional insured/waiver language. Demand attached endorsement copies if noted.

- Ensure Primary/Non-Contributory: Explicitly stated.

- Validate Insurer: Reputable carrier with acceptable ratings.

- Match Insured Name: Exact legal entity performing work.

Track expirations and request renewals early.

Practical Examples and Scenarios

Let’s apply this with real-world cases.

Example 1: Small Residential Remodel

Project: Kitchen renovation ($150,000 value). Sub: Plumbing contractor. Required: $1M/$2M GL, additional insured (GC only), waiver of subrogation.

The plumber provides a COI showing $1M occurrence/$2M aggregate, blanket additional insured, and waiver. You verify endorsements attached.

Relevance: Low-risk project, standard limits suffice. Without the COI, a leak causing $50,000 in water damage falls on your policy.

Example 2: Commercial Build-Out

Project: Office fit-out ($2M+). Sub: Electrical contractor. Required: $2M/$4M GL + $5M umbrella, additional insured (GC + owner), primary/non-contributory.

COI shows required limits, CG 20 10/20 37 endorsements for ongoing/completed ops. Umbrella follows form.

Relevance: Higher exposure justifies elevated limits. Completed ops protects against post-handover wiring faults.

Example 3: High-Rise Exterior Work

Project: Facade repair on 20-story building. Sub: Scaffold/roofing specialist. Required: $1M/$2M GL (no height exclusion), additional insured blanket, no residential exclusion.

Initial COI has height limitation—rejected. Sub upgrades policy, provides clean COI.

Relevance: Trade-specific risks demand scrutiny of exclusions.

Try testing scenarios: What if a sub’s aggregate exhausts mid-project? Higher limits or separate per-project policies mitigate this.

Best Practices for Managing Subcontractor COIs

- Require COIs before work starts—and hold payment until received.

- Use digital tracking tools for expirations/compliance.

- Include clear insurance specs in subcontracts.

- Consult your agent for red flags.

Explore general liability insurance for online small business sellers for parallels in other sectors.

FAQs About General Liability Certificate for Subcontractors Requirements

1. Is a certificate of liability insurance the same as being an additional insured?

No. The COI is proof; additional insured status requires a policy endorsement extending coverage to you.

2. What if my subcontractor’s COI expires during the project?

Demand a renewal COI immediately. Gaps expose you to liability—consider suspending work until resolved.

3. Can I accept a COI without attached endorsements?

Best practice: No. Notes like “additional insured per attached” require the actual forms for verification.

Extra tip: Always name the owner as certificate holder if required upstream.

Conclusion

Mastering general liability certificate for subcontractors requirements protects your business from preventable risks while ensuring smooth project execution. By enforcing proper limits, endorsements, and verification, you transfer liability effectively and build trust with owners and clients.

Review your subcontract templates today, test different requirement scenarios with your subs, and consult experts for tailored advice. Strong insurance practices aren’t just compliance—they’re a competitive edge.

For home-based operations, see small business insurance requirements for home-based LLC.