General Liability Insurance for Online Small Business Sellers

General Liability Insurance for Online Small Business Sellers

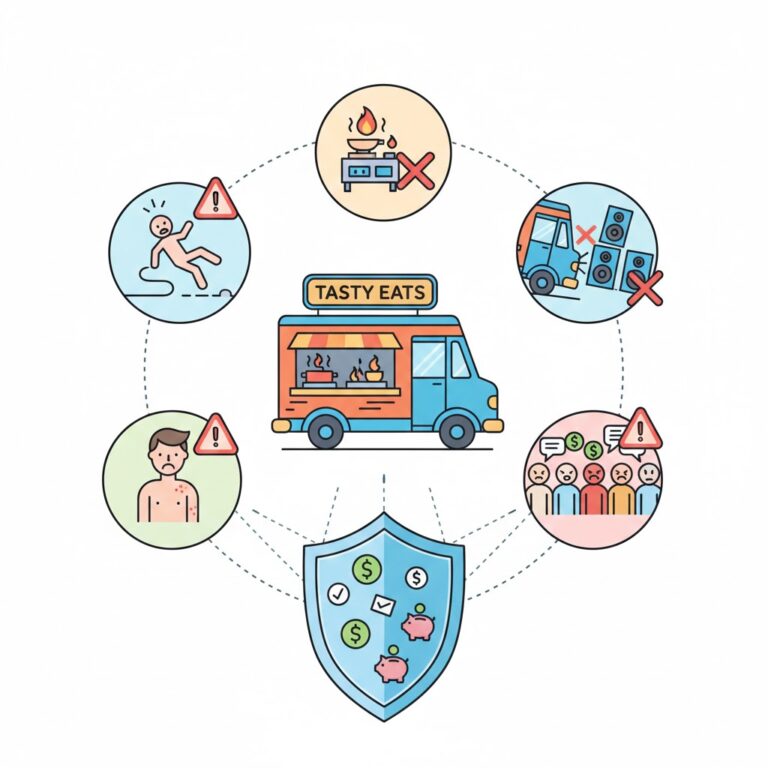

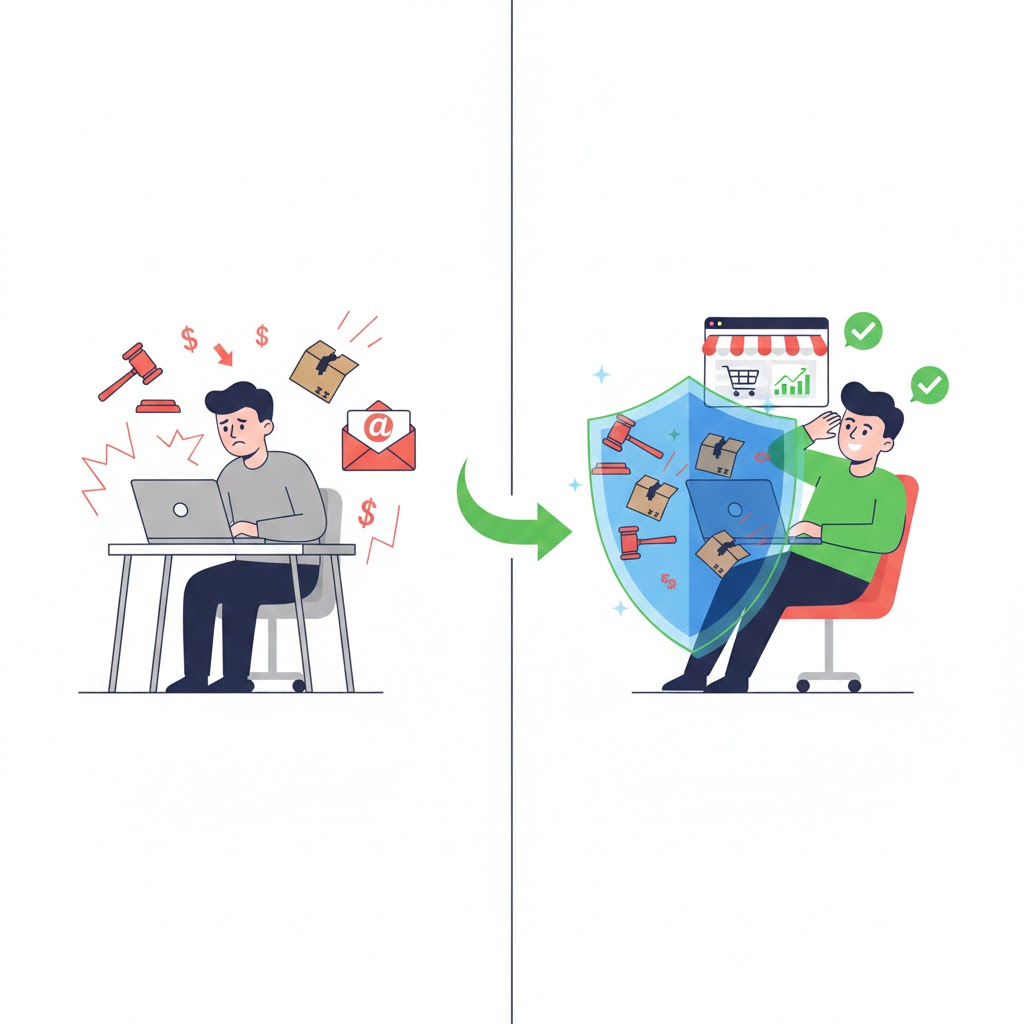

Imagine this: You’ve built a thriving online store selling handmade jewelry or dropshipped electronics. Sales are rolling in, reviews are glowing, and then—out of nowhere—a customer claims one of your products caused an allergic reaction, leading to medical bills and a lawsuit demanding thousands in compensation. Or perhaps a delivery partner slips on your doorstep while picking up inventory from your home-based operation. Suddenly, your hard-earned profits are at risk. This is where general liability insurance for online small business sellers comes in as a critical safety net, protecting your e-commerce venture from unexpected third-party claims that could otherwise derail your business.

In today’s digital marketplace, even purely online sellers face real-world risks. Platforms like Amazon often require proof of liability coverage once your sales hit certain thresholds (typically $10,000 in a month), and without it, you could lose selling privileges. Beyond compliance, this insurance provides peace of mind, covering costs related to bodily injury, property damage, and advertising injuries—common pitfalls for small online businesses. Whether you’re a solo Etsy seller or scaling on Shopify, understanding and securing the right coverage is essential for long-term success.

What Is General Liability Insurance?

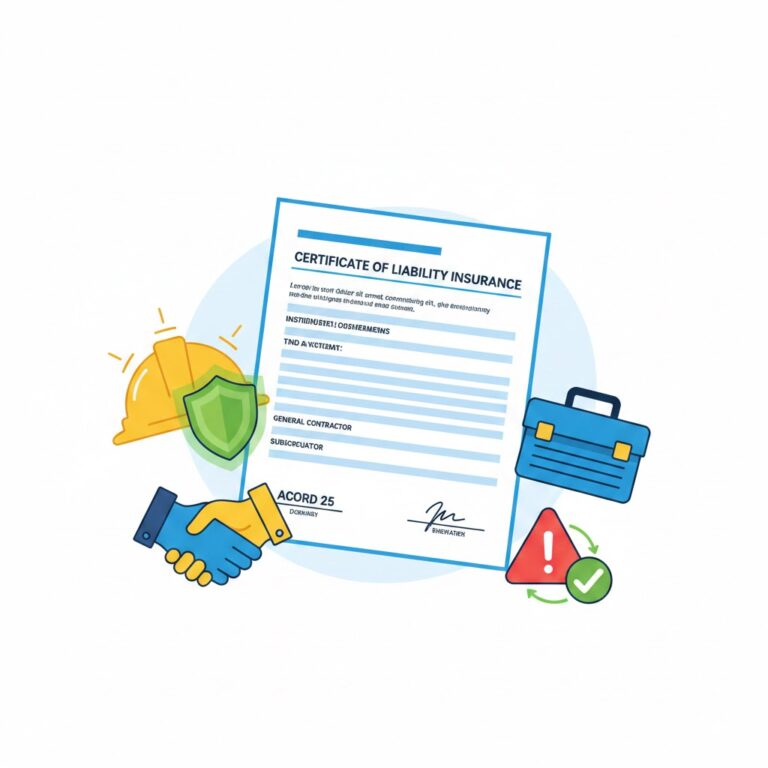

General liability insurance (often called commercial general liability or CGL) is a foundational policy that shields your business from claims made by third parties—customers, vendors, or anyone not employed by you. It’s designed to cover incidents arising from your business operations, products, or premises.

For online small business sellers, this coverage is particularly valuable because e-commerce blurs the lines between virtual and physical risks. Key components include:

- Bodily injury: Covers medical expenses if someone gets hurt due to your business (e.g., a customer injured by a defective product).

- Property damage: Pays for repairs if your operations damage someone else’s property.

- Personal and advertising injury: Protects against claims like libel, slander, or copyright infringement in your marketing.

- Product liability: Often bundled in, this addresses claims from products you sell causing harm or damage.

Unlike professional liability (errors and omissions), which covers service mistakes, general liability focuses on general operations. Many policies for e-commerce include product liability automatically, making it a one-stop solution for sellers.

Why Do Online Small Business Sellers Need General Liability Insurance?

You might think, “My business is 100% online—no storefront, no foot traffic—so why bother?” But risks don’t disappear just because you’re behind a screen. Here’s why it’s indispensable:

- Platform Requirements: Amazon mandates at least $1 million in general liability coverage for sellers exceeding sales thresholds. Other marketplaces like Walmart or Etsy may follow suit or recommend it.

- Product-Related Claims: Even if you dropship, you’re often liable as the seller if a product causes injury (e.g., a faulty charger sparking a fire).

- Operational Incidents: Home-based sellers might host pickups or meetings, leading to slips, falls, or damage.

- Advertising Risks: Online marketing can trigger lawsuits over misleading claims or unauthorized images.

- Lawsuit Protection: Legal defense alone can cost tens of thousands, even if you’re not at fault.

Statistics underscore the need: Small businesses face lawsuits frequently, with average settlements in the five figures. Without coverage, you’d pay out-of-pocket, potentially wiping out your business.

For more on overall business protection, check our guide on business insurance basics.

What Does General Liability Insurance Cover for E-Commerce Sellers?

Standard policies protect against:

Core Coverages

- Bodily injury and medical payments.

- Property damage to third-party assets.

- Personal/advertising injury (e.g., defamation in reviews or ads).

E-Commerce Specifics

- Product-completed operations: Claims from products after sale.

- Often includes cyber elements in bundles, though dedicated cyber insurance is recommended for data breaches.

Exclusions typically include employee injuries (covered by workers’ comp), intentional acts, or professional errors.

Many insurers bundle this into a Business Owner’s Policy (BOP), adding commercial property coverage for inventory—ideal for online sellers storing stock.

Real-Life Scenarios: How Claims Work for Online Sellers

Let’s break down practical examples to show relevance.

Scenario 1: Product Defect Claim

You sell kitchen gadgets online. A customer claims a blender blade broke, causing a cut requiring stitches ($15,000 in medical costs + lost wages). They sue for $50,000.

- Coverage: Product liability pays medical bills, legal fees, and settlement (up to limits).

- Why relevant: As the seller, you’re liable—even for manufacturer defects. Real claims like this happen with imported goods.

Scenario 2: Advertising Injury

Your ad uses a stock photo without full rights; the photographer sues for copyright infringement ($20,000 demand).

- Coverage: Advertising injury handles defense and damages.

- Relevance: Common in competitive e-commerce marketing.

Scenario 3: Premises Incident

A delivery driver trips on boxes at your home warehouse, breaking an arm ($30,000 claim).

- Coverage: Bodily injury covers treatment and lawsuit costs.

- Relevance: Home-based sellers often overlook “premises” risks.

In each case, insurance covers defense costs (average $45,000+ per lawsuit), regardless of fault.

How Much Does General Liability Insurance Cost for Online Small Businesses?

Costs vary, but for low-risk e-commerce sellers, expect affordability.

Average Costs (2025-2026 Data)

- Monthly: $25–$85 (often $40–$60 for small online sellers).

- Annually: $300–$1,000+.

- Factors influencing price:

- Revenue/sales volume (higher sales = higher premiums).

- Product type (high-risk items like electronics cost more).

- Coverage limits ($1M/$2M common).

- Location and claims history.

Example calculation: Base rate × exposure (e.g., revenue factor) + adjustments.

For a $100,000-revenue Etsy seller: ~$400/year. Scaling to $500,000: ~$800/year.

Bundle into a BOP for 10–20% savings. Providers like NEXT or Thimble offer quotes starting low for digital-heavy businesses.

Choosing the Best Provider for E-Commerce General Liability

Top options tailored for online sellers:

- NEXT Insurance: 100% online quotes, affordable (~$25/month start), includes product liability.

- Hiscox: Customizable for e-commerce, strong on advertising injury.

- The Hartford: Excellent for bundles, low complaints.

- Progressive Commercial: Good for growing sellers with add-ons.

- Insureon: Compare multiple quotes easily.

Shop around—get 3–5 quotes. Look for Amazon-compliant policies.

Related: See costs for small LLCs in general liability insurance cost for small LLCs in Florida.

Additional Coverages to Consider

While general liability is core:

- Cyber liability for data breaches.

- Professional liability if consulting.

- Workers’ comp for employees (see workers’ compensation insurance for remote employees in California).

Family-owned? Explore workers’ comp exemptions for family-owned businesses.

Freelancers: Professional liability requirements in Texas.

FAQs

Do I really need general liability if I’m a small online seller with low sales?

Yes—risks exist from day one, and platforms may require it as you grow. It’s affordable protection against devastating claims.

Is product liability included in general liability for e-commerce?

Often yes, especially with retailers/online sellers. Confirm with your provider.

How do I get a quote quickly?

Many like NEXT or Insureon offer instant online quotes. Input business details, revenue, and products for accurate pricing.

Extra tip: Review annually—as sales increase, adjust limits.

Conclusion

General liability insurance for online small business sellers isn’t just a checkbox—it’s a smart investment that safeguards your passion project from unpredictable risks. From product claims to advertising mishaps, it ensures one bad incident doesn’t end your entrepreneurial journey.

Start by getting quotes today; test scenarios with different revenue levels to see costs. Explore bundled options for savings, and pair with related guides on our site for comprehensive protection.

Your online business deserves to thrive securely—secure the right coverage and focus on growth.