Small Business Insurance Requirements for Home-Based LLC

Small Business Insurance Requirements for Home-Based LLC

Imagine this: You’ve just launched your dream home-based LLC—perhaps as a freelance consultant, online seller, or graphic designer. You’re working from your dining room table, excited about the flexibility and low overhead. Then, a client visits for a meeting, trips over your laptop cord, and injures themselves. Or a package you shipped arrives damaged, sparking a lawsuit. Suddenly, you’re facing medical bills, legal fees, or settlement costs that could wipe out your savings. This is where understanding small business insurance requirements for home-based LLC becomes crucial. While forming an LLC offers some personal asset protection, it doesn’t shield your business from everyday risks—and standard homeowners insurance often falls short.

Running a home-based LLC is incredibly common in the U.S., with millions of entrepreneurs operating this way for its convenience and cost savings. But insurance needs differ from traditional office-based businesses. Legally required coverages are minimal for most solo or no-employee operations, but recommended policies can protect your livelihood. In this comprehensive guide, we’ll break down what’s required, what’s smart to have, costs, real-world examples, and how to get covered—drawing from real expertise in small business protection.

Why Home-Based LLCs Need Dedicated Business Insurance

Many new LLC owners assume their homeowners insurance covers everything since the business is at home. Unfortunately, that’s rarely true. Standard homeowners policies typically limit business property coverage to $2,500–$5,000 (often less off-premises) and exclude business-related liability entirely. If a client sues over advice you gave or damage from your operations, your personal policy won’t help—and could even be voided if the insurer learns about unreported business activity.

An LLC structure protects personal assets from business debts in most cases, but it doesn’t replace insurance. Lawsuits can still drain business funds, and without coverage, you’d pay out-of-pocket. Home-based risks include client visits, shipped products, professional errors, or cyber threats from handling client data.

Key semantic terms: home office insurance, LLC liability protection, business owners policy (BOP) for home-based, errors and omissions for remote workers.

Legally Required Insurance for Home-Based LLCs

Insurance mandates vary by state, industry, and employee count. Here’s the breakdown:

Workers’ Compensation Insurance

- Most common requirement: Nearly all states mandate workers’ comp for businesses with employees (even part-time).

- For no-employee/single-member LLCs: Generally not required. Owners/members are often exempt, but you can opt in for personal protection.

- Examples: In states like New York, Texas, and California, solo LLCs without employees have no mandate.

- Exception: Construction or high-risk trades may require it regardless.

- If you hire subcontractors, check if they’re covered—otherwise, you could be liable.

- Why consider it anyway? Covers medical bills and lost wages if you’re injured on the job (personal health insurance often denies work-related claims).

Other Mandated Coverages

- Commercial auto: Required if you use a vehicle for business (beyond commuting).

- Professional licenses: Some fields (e.g., real estate, accounting) require specific bonds or liability.

- No broad general liability mandate: Unlike workers’ comp, general liability insurance isn’t legally required in most states for home-based LLCs.

Always check your state’s department of insurance or labor website for specifics. For broader guidance, explore general business insurance basics.

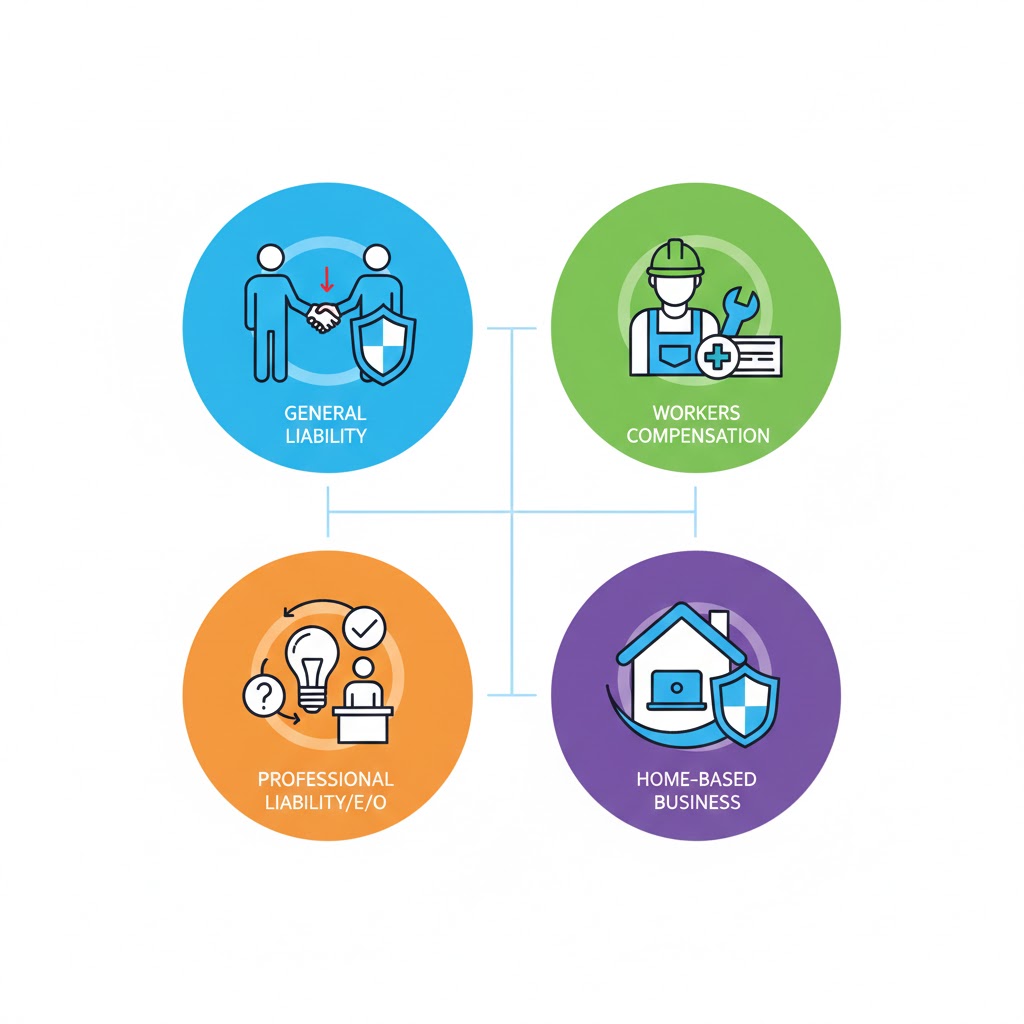

Recommended Insurance Types for Home-Based LLCs

Even without legal mandates, these coverages build strong protection:

General Liability Insurance

- Covers third-party bodily injury, property damage, and advertising claims.

- Essential for client interactions or product sales.

- Average cost: $500–$1,000/year for small home-based operations (often $40–$80/month).

Professional Liability (Errors & Omissions) Insurance

- Protects against claims of negligence, mistakes, or undelivered services.

- Critical for consultants, freelancers, or advisors.

- Often required by clients.

Business Owner’s Policy (BOP)

- Bundles general liability + commercial property.

- Ideal for home-based with equipment/inventory.

- Covers business interruption too.

Cyber Liability

- For data breaches if you handle client info.

Homeowners Endorsement vs. Standalone Policy

- Add a rider to homeowners for minor coverage (limited to low-risk, low-revenue ops).

- Better: Standalone or BOP for comprehensive protection.

Related: See how general liability costs vary for small LLCs in Florida or options for online small business sellers.

Factors Affecting Insurance Costs for Home-Based LLCs

Premiums depend on:

- Industry risk: Low for desk-based (e.g., consulting ~$500/year); higher for hands-on (e.g., cleaning ~$1,500+).

- Revenue/payroll: Higher volume = higher premiums.

- Location: Urban or high-crime areas cost more.

- Claims history: Clean record = discounts.

- Coverage limits: $1M/$2M occurrence/aggregate is standard.

Sample calculation: Base rate × exposure factor × discounts.

For example, a home-based consultant with $100K revenue might pay:

- General liability: ~$600/year.

- Add professional liability: +$400–$800.

Bundle into a BOP and save 10–20%.

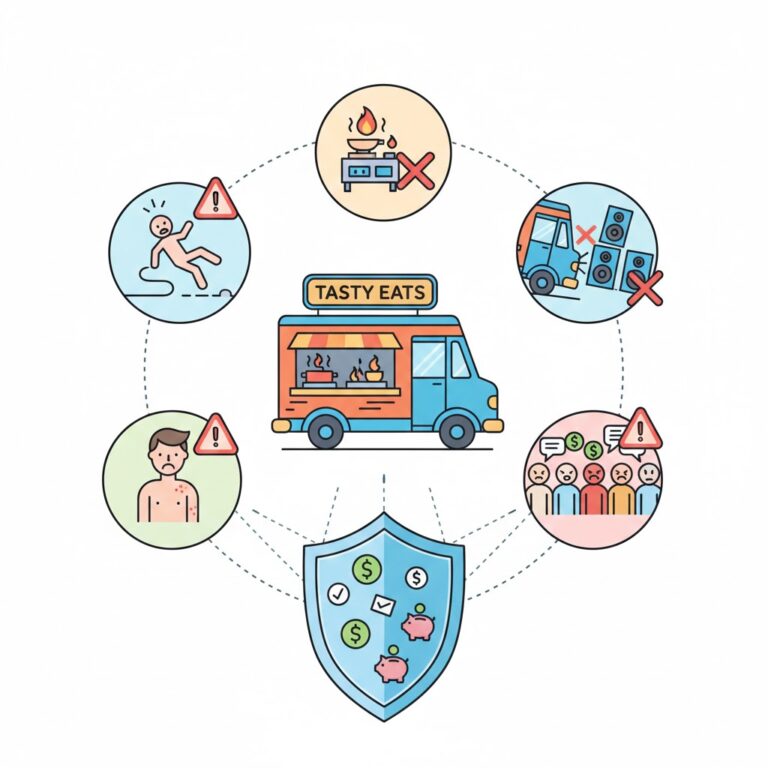

Real-Life Examples and Scenarios

Example 1: Freelance Graphic Designer (Solo LLC)

- Scenario: Client claims your design infringed copyright, suing for $15,000.

- Without professional liability: Pay legal fees + settlement yourself.

- With coverage: Policy handles defense and payout (up to limit).

- Relevance: Common for creative home-based work. Cost: ~$500/year for $1M coverage.

Example 2: Online Etsy Seller (Home-Based LLC)

- Scenario: Shipped product damages buyer’s property; they sue.

- General liability covers.

- Homeowners won’t—excludes business shipments.

- Average claim: $20,000+ (medical/legal).

- Cost: $700–$1,200/year.

Example 3: Home Consultant with Occasional Visits

- Scenario: Visitor slips on stairs during meeting.

- General liability pays medical (~$10,000 average slip-fall).

- Add workers’ comp if you later hire help.

- Opt-in for owner: Covers your injury (e.g., repetitive strain).

Statistics: Small businesses face ~40% chance of lawsuit in any 10-year period (per insurers like Hiscox).

Test scenarios: Adjust revenue or add employees in quotes to see cost changes.

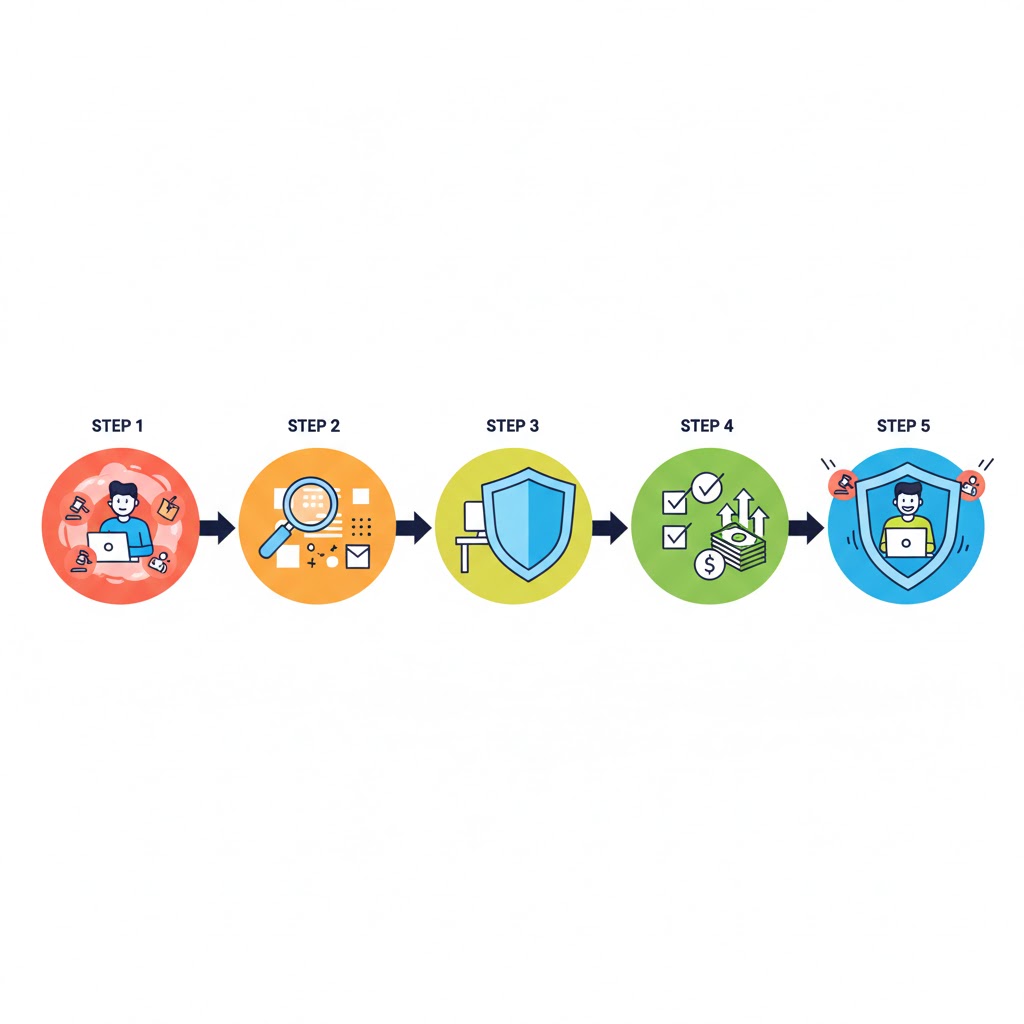

How to Choose and Buy Insurance

- Assess risks: List operations, clients, equipment.

- Get quotes: Compare 3–5 providers.

- Bundle for savings.

- Review annually.

Related resources: Workers’ compensation rates for independent contractors or exemptions for family-owned businesses.

FAQs

Do I need insurance if my home-based LLC has no employees?

Legally, often no for workers’ comp. But general/professional liability is highly recommended—clients may require it, and it protects against lawsuits.

Does homeowners insurance cover my home office equipment?

Limited (usually $2,500–$5,000). Business losses (theft, damage) often excluded. Add endorsement or BOP.

How much does general liability cost for a home-based small business?

$500–$1,200/year typically; lower (~$400–$800) for low-risk like consulting.

Extra tip: Pay annually for discounts; maintain safety practices to lower rates.

Conclusion

Understanding small business insurance requirements for home-based LLC empowers you to protect your venture without overpaying. While mandates are few for solo operations, skipping recommended coverages like general liability or professional liability risks financial ruin from one mishap. Start with a needs assessment, get tailored quotes, and bundle for efficiency.

Explore related guides on deqnow.com for deeper insights, and test different scenarios to find your perfect fit. Your home-based LLC deserves solid protection—secure it today for peace of mind tomorrow.