Workers Comp Exemptions for Family Owned Business USA Rules

Workers Comp Exemptions for Family Owned Business USA Rules

Imagine running a small family-owned construction company in California. Your spouse handles the books, your adult child works on job sites, and your sibling helps with deliveries. One day, your child slips on a wet surface and breaks an arm, racking up thousands in medical bills and lost wages. Without proper coverage, you could face lawsuits or massive out-of-pocket costs. This is where understanding workers comp exemptions for family owned business USA rules becomes critical—it can save you money on premiums while ensuring compliance and protection.

Workers’ compensation insurance is mandatory in most states for businesses with employees, providing medical benefits, wage replacement, and disability payments for work-related injuries or illnesses. However, family-owned businesses often qualify for exemptions, particularly for relatives like spouses, children, parents, or siblings. These rules vary significantly by state, business structure (sole proprietorship, partnership, LLC, or corporation), and whether the family member is an owner or employee. Navigating these exemptions helps avoid penalties, which can include fines up to $100,000 or more in states like California, while still protecting your loved ones.

In this guide, we’ll break down the key rules, common exemptions, and practical examples to help family business owners make informed decisions.

Understanding Workers’ Compensation Basics for Family Businesses

Workers’ compensation (often called workers comp) is a no-fault system: employees get benefits regardless of who caused the injury, and in exchange, they generally can’t sue the employer. Nearly every state requires it, except Texas where it’s optional.

For family-owned businesses, the big question is: Do relatives count as “employees” requiring coverage? The answer depends on:

- State laws: Most states mandate coverage starting with 1-5 employees, but exclude certain relatives.

- Business entity: Sole proprietors and partnerships often have broader family exemptions than corporations or LLCs.

- Relationship and role: Immediate family (spouses, children, parents) frequently qualify for exemptions, especially in agriculture or small operations.

- Ownership: Corporate officers or LLC members who own a percentage (often 10-25%) can elect to exclude themselves.

Semantic terms like family member exclusions, owner-officer waivers, and relative exemptions all point to the same goal: reducing premiums for closely held businesses without leaving families vulnerable.

Even if exempt, many experts recommend voluntary coverage—personal health insurance often denies work-related claims, leaving gaps.

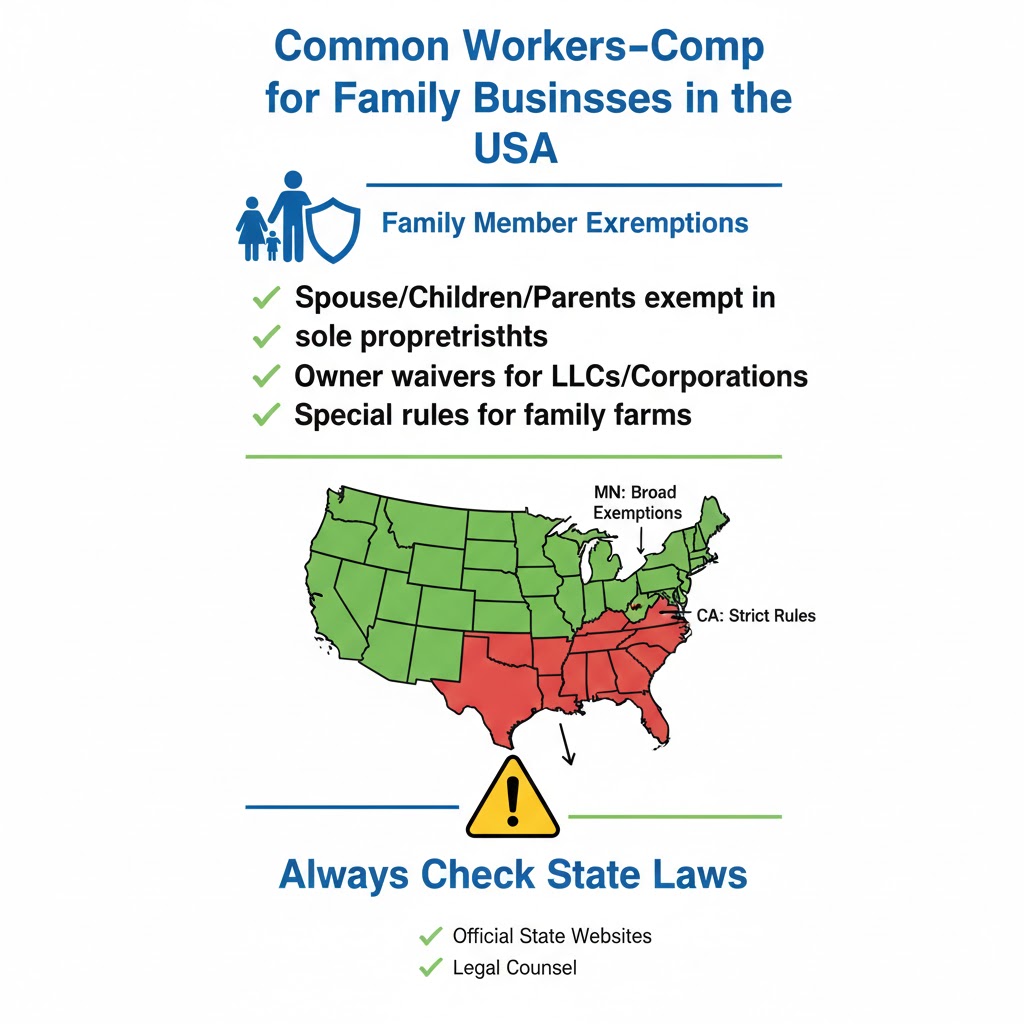

Common Exemptions Across States

Rules aren’t uniform, but patterns emerge:

Sole Proprietors and Partnerships

- In many states (e.g., Minnesota, Iowa, Nebraska), sole proprietors aren’t required to cover themselves, spouses, parents, or children—regardless of hours worked.

- Partnerships follow similar rules: Partners and their immediate family are often exempt.

- Example: A husband-wife sole proprietorship running a retail shop can exclude both owners and any helping children.

LLCs and Corporations

- LLC members or corporate officers owning 10%+ stock can often file a waiver to exclude themselves.

- Family extensions: If the officer qualifies, spouses/children may also be excluded (e.g., Minnesota for closely held corps with 25% ownership).

- New York: One- or two-person owned corporations (owning all stock) with no other employees (including unpaid family) are fully exempt.

Agricultural and Farm Businesses

- Many states (Iowa, Kansas, Nebraska) exempt family farms employing only relatives (spouses, children, parents, siblings).

- Non-farm family businesses rarely get this broad exemption.

Small Employee Thresholds with Family Rules

- Oklahoma: Businesses with 5 or fewer family employees are exempt.

- Tennessee: Family members exempt if family owns 95%+.

Always verify with your state’s workers’ compensation board, as laws change (current as of 2026).

State-by-State Overview of Key Family Exemptions

Here’s a snapshot of notable rules (not exhaustive—consult official sources):

- California: Strict—no broad family exemptions. Immediate family may qualify in some cases, but generally, any employee (including relatives) requires coverage if there’s one or more workers. Owners/officers can exclude via waiver.

- Texas: Optional overall, but if you opt in, family rules follow general exemptions.

- Florida/New York: Corporate officers can exclude; no special family employee exemptions beyond owner waivers.

- Minnesota: Broad—sole proprietors/partnerships exclude spouses/parents/children; closely held corps/LLCs exclude qualifying officers and their relatives.

- Oklahoma: Up to 5 family employees exempt.

- Iowa/Nebraska: Family farms exempt for blood/marriage relatives.

For a full list, resources like the U.S. Department of Labor or state-specific guides are essential.

Practical Scenarios and Examples

Let’s apply this with real-world examples.

Scenario 1: Sole Proprietorship Family Retail Store

You’re a sole proprietor in Minnesota with your spouse and two adult children helping part-time.

- Exemption: No coverage required for yourself, spouse, parents, or children.

- Why relevant: Saves on premiums (average $1,000-5,000/year for small businesses). If a child injures themselves, personal health insurance might cover, but work-related denials are common—consider voluntary addition.

- Tip: Test scenarios—add non-family help? Coverage becomes mandatory.

Scenario 2: Family-Owned LLC in California

An LLC with you, your sibling (members), and your parent as a paid employee.

- Exemption: Members can waive personal coverage if owning enough; but paid parent likely requires inclusion unless qualifying as owner.

- Calculation example: Premiums based on payroll. Assume $50,000 annual payroll at $2 per $100 rate: Premium = ($50,000 / 100) × $2 = $1,000. Excluding owners reduces this.

- Relevance: California penalties are severe—fines plus full claim costs if uninsured.

Scenario 3: Corporate Family Construction Business in Florida

Corporation with three officer-siblings owning stock.

- Exemption: Up to three officers (10%+ ownership) can file exemption for construction.

- Step-by-step:

- Each owns ≥10%.

- File Notice of Election to be Exempt online.

- Renew every 2 years.

- Why: Construction has high rates; exemption lowers costs significantly.

Scenario 4: Small Family Farm in Iowa

Farm corporation employing only spouses and children.

- Exemption: Full exclusion for family relatives.

- Statistic: Ag injuries are common (NIOSH reports ~400 fatalities/year nationally); voluntary coverage provides peace of mind.

Encourage testing: Run quotes with/without family included to see savings.

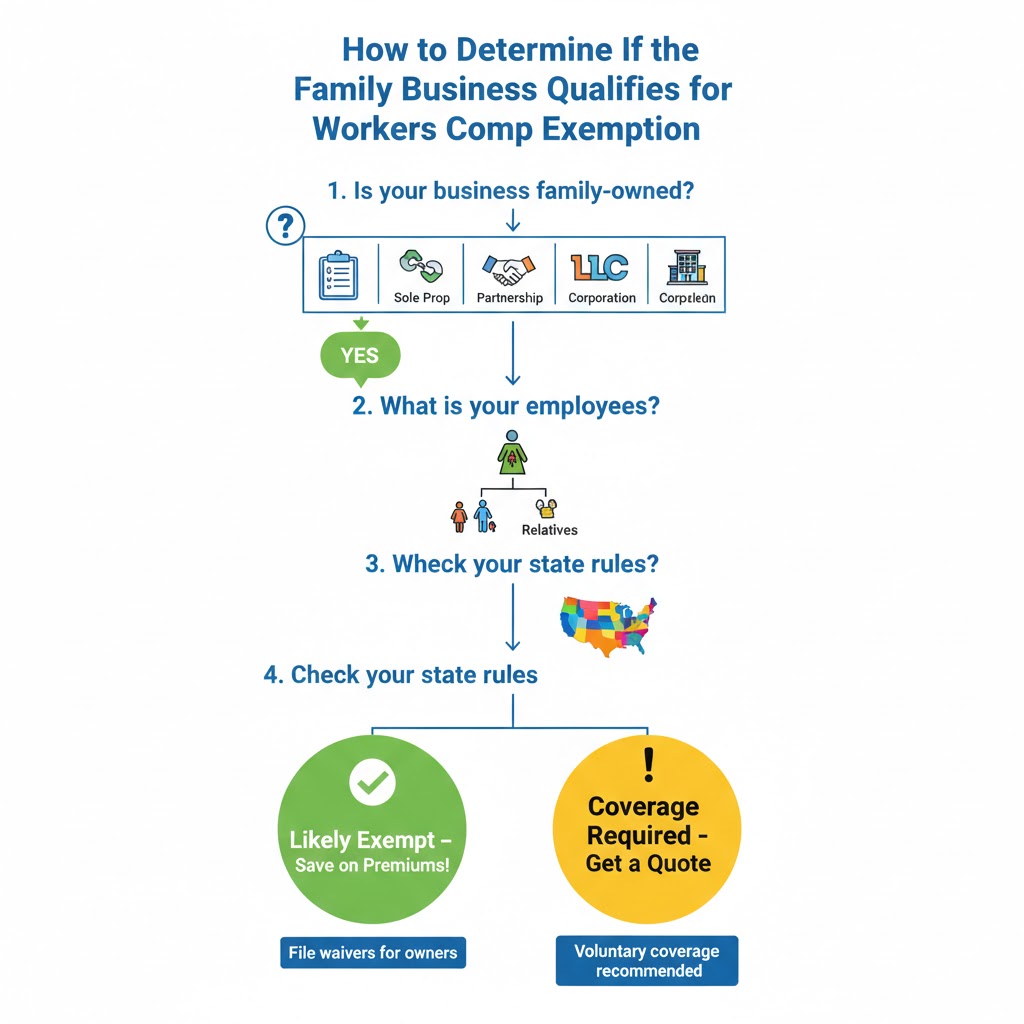

How to Apply for Exemptions

Most states require forms:

- Waiver for officers/members.

- Filed with insurer or state board.

- Often online (e.g., Florida’s Division of Workers’ Compensation).

Even exempt, post notices and consider general liability insurance for gaps.

For broader protection, explore business insurance options or remote employee rules.

Risks of Skipping Coverage Even When Exempt

- Lawsuits from injured relatives.

- Client requirements (many demand proof of coverage).

- Medical bills averaging $40,000+ for serious injuries.

FAQs

Do I need workers’ comp if my only employees are family members?

It depends on your state and entity. In states like Minnesota or Oklahoma, often no for immediate family. In California or New York, usually yes unless owners waive.

Can spouses or children be excluded in an LLC?

Yes in many states if they qualify as members/officers with ownership and file waivers. Check percentage thresholds (10-25%).

What if my family business grows and hires non-relatives?

Coverage becomes mandatory for all employees; family exemptions may still apply to relatives.

Extra tip: Document relationships and roles—audits can challenge exemptions.

Conclusion

Workers comp exemptions for family owned business USA rules offer valuable flexibility, especially for sole proprietors, partnerships, and closely held entities with immediate relatives. Key takeaways: Rules vary by state, focus on ownership and relationship, and exemptions reduce costs but don’t eliminate risks.

Always consult your state’s workers’ comp board or an insurance expert. Test different scenarios with quotes, and consider voluntary coverage for true protection. Explore related guides like workers’ compensation for remote employees in California or general liability for small LLCs in Florida to round out your coverage.

Stay compliant and protected—your family business deserves it.