Workers Compensation Insurance for Remote Employees in California

Workers Compensation Insurance for Remote Employees in California – A Complete Guide

Imagine this: Sarah, a software developer for a tech startup based in San Francisco, has been working remotely from her home office for the past two years. One afternoon, while reaching for her laptop charger during a video call, she slips on a loose rug and fractures her wrist. Is this injury covered? As an employer or HR manager, would your business be protected? These scenarios are increasingly common in today’s hybrid workforce, and workers compensation insurance for remote employees in California is the critical safety net that addresses them.

California’s workers’ compensation system is one of the most robust in the nation, designed to protect both employees and employers regardless of where work happens. Whether your team is fully remote, hybrid, or occasionally working from home, understanding these requirements isn’t just compliance—it’s essential for risk management, employee retention, and financial stability. In this guide, we’ll break down the laws, coverage details, common challenges, and practical steps to ensure you’re covered.

Understanding California Workers’ Compensation Basics

California Labor Code $3700 mandates that any employer with at least one employee must carry workers’ compensation insurance. This applies equally to full-time, part-time, and remote workers—no exceptions based on location or hours worked.

Workers’ compensation is a no-fault system: It provides benefits like medical treatment, temporary disability payments, permanent disability awards, and vocational rehabilitation without requiring proof of employer negligence. In return, employees generally can’t sue their employer for workplace injuries.

Key semantic terms to know:

- Arising Out of Employment (AOE): The injury must be caused by work duties.

- Course of Employment (COE): It must occur during work-related activities or hours.

- Telecommuter or remote worker coverage: Standard workers’ comp extends to home offices, co-working spaces, or even coffee shops if the activity is job-related.

The Division of Workers’ Compensation (DWC), part of the Department of Industrial Relations (DIR), oversees the system. Penalties for non-compliance are severe: stop-work orders, fines up to $100,000, and even criminal charges.

Why Remote Work Doesn’t Change the Core Requirement

Remote work exploded post-pandemic, but California’s laws evolved to include it seamlessly. Injuries like repetitive strain (e.g., carpal tunnel from typing), ergonomic issues, or slips during work hours are compensable if tied to job duties. The Workers’ Compensation Insurance Rating Bureau (WCIRB) assigns classification codes based on job functions, not location—meaning a remote administrative employee uses clerical codes (8810), while a remote consultant might fall under professional codes.

Coverage for Remote Employees: In-State vs. Out-of-State

One of the biggest pain points for distributed teams is jurisdiction.

Remote Employees Living and Working in California

Straightforward: Full coverage required. If your business operates in California (headquartered, has employees, or contracts here), remote workers in the state are covered under your policy.

Remote Employees Living Outside California

This gets nuanced:

- If the employee was hired in California, performs some work here (e.g., occasional travel), or the contract specifies California law, your CA policy likely applies.

- If hired out-of-state, never works in CA, and reports to non-CA management, California jurisdiction may not apply—but the employee’s home state laws will.

- Best practice: Secure multi-state coverage or endorsements. Many insurers offer “all states” or “foreign voluntary” options. For out-of-state remote workers, you may need separate policies in their resident state to avoid gaps.

Real-Life Scenario Example 1: A Los Angeles-based marketing firm hires a remote content writer living in Texas. The writer develops RSI from prolonged keyboard use. If the hiring contract was executed in CA and the writer occasionally collaborates on CA projects, California’s generous benefits (higher temporary disability rates) could apply. Premiums might increase due to CA’s higher costs.

Common Remote Work Injuries and Compensability

Remote claims often face scrutiny because there’s no witness. Insurers investigate whether the injury truly occurred in the “course and scope” of employment.

Common covered injuries:

- Ergonomic/repetitive strain: Carpal tunnel, back pain from poor setup.

- Slips and falls: Tripping over cords while heading to a printer during work hours.

- Acute incidents: Chair collapse or electrical shock from work equipment.

Not covered:

- Injuries during personal breaks (e.g., cooking lunch and burning yourself).

- Commuting exceptions (though remote work blurs “coming and going” rule—home is the workplace).

Pro Tip: Document designated work areas and hours in remote policies to strengthen compensability.

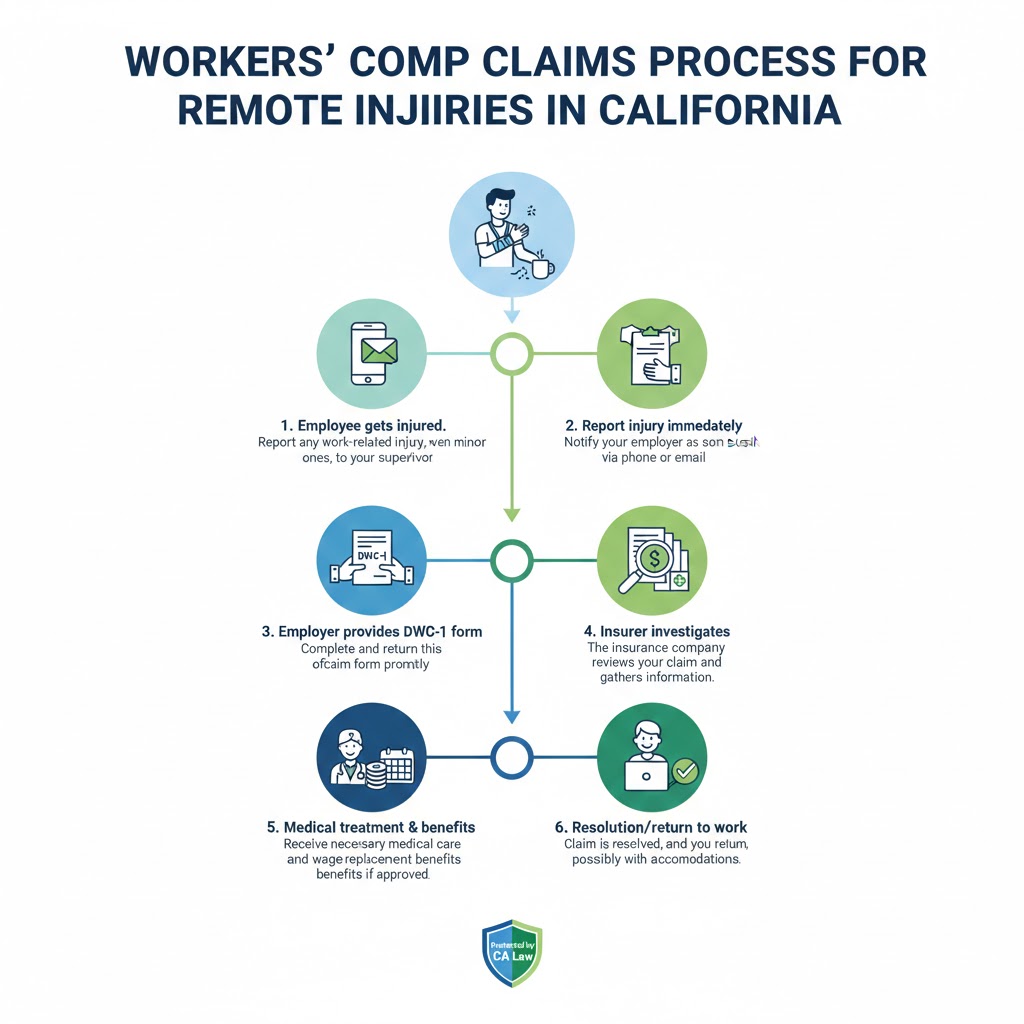

Step-by-Step Claims Process for Remote Injuries

- Employee Reports Injury: Within 30 days (ideally immediately) to supervisor via email or form.

- Employer Provides DWC-1 Form: Must give claim form within 24 hours of notice.

- File with Insurer: Employer reports to carrier; investigation begins.

- Medical Evaluation: Qualified Medical Evaluator (QME) or Agreed Medical Evaluator (AME) assesses if needed.

- Benefits Decision: Accepted claims provide medical care, wage replacement (typically 66 2/3% of average weekly wage, capped at state maximum—around $1,500/week in 2025).

Encourage employees to take photos of the incident scene and note exact timing.

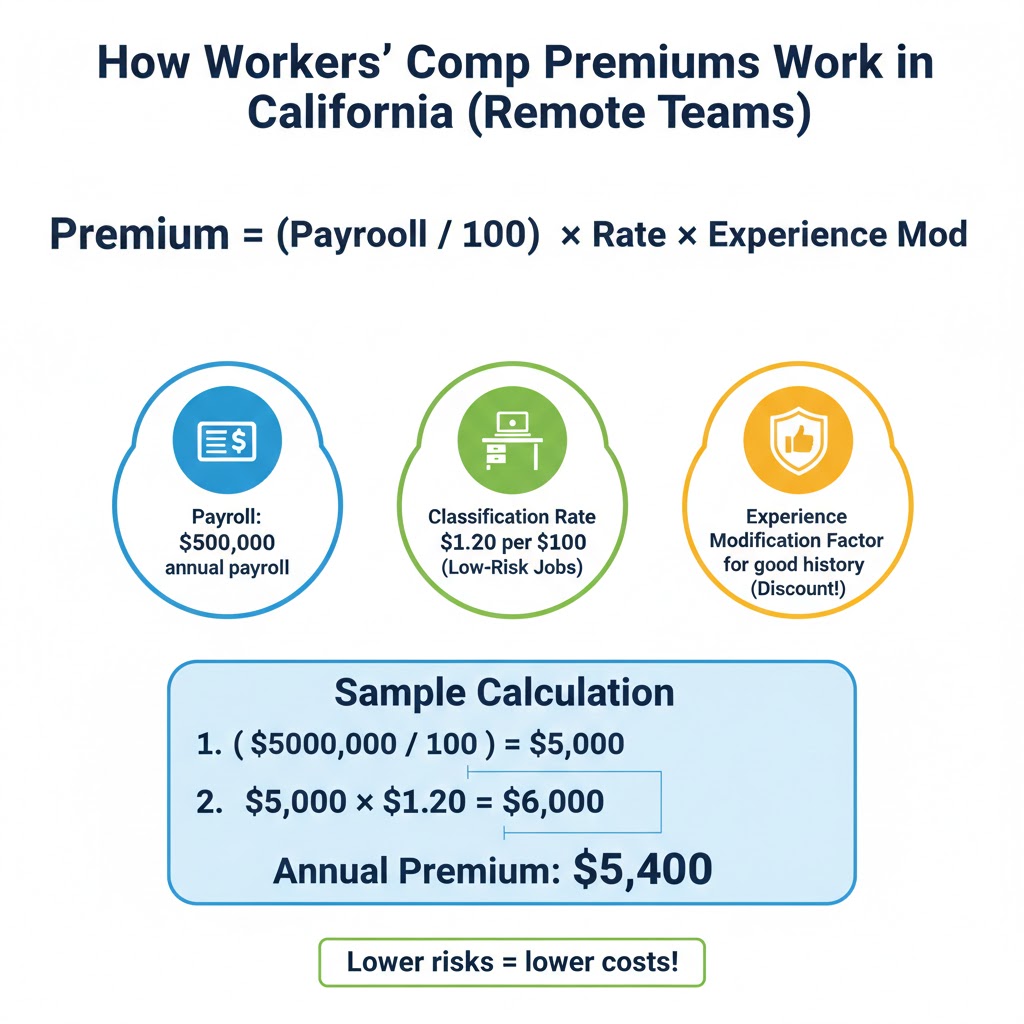

How Premiums Are Calculated for Remote Employees

Workers’ comp premiums aren’t flat fees—they’re payroll-based.

Basic Formula:

Premium = (Payroll / 100) × Classification Rate × Experience Modification Factor (EMR or X-Mod)- Payroll: Total gross wages (include bonuses, but exclude overtime premium).

- Classification Rate: Set by WCIRB; remote clerical work often $0.50–$2 per $100 payroll (low risk).

- Experience Mod: Based on your claims history; below 1.0 for good record (discount), above for poor.

Example Calculation 2: A small tech company with $500,000 annual payroll for 5 remote employees (clerical code 8810, rate ~$1.20 per $100). EMR 0.90 (good safety record).

Base Premium = ($500,000 / 100) × $1.20 = $6,000

Adjusted = $6,000 × 0.90 = $5,400 annual premiumAdd audits: Most policies are auditable—report payroll monthly or quarterly to avoid end-of-year surprises.

Example 3: High-risk remote role (e.g., field sales with driving). Rate $5–$10 per $100. Same payroll: Base $25,000–$50,000 before mod.

Test scenarios: Use online rate estimators from providers like State Fund or brokers to plug in different payrolls/class codes.

Choosing the Right Insurance Provider in California

California has a competitive market, including the State Compensation Insurance Fund (State Fund)—a nonprofit “insurer of last resort” with stable rates.

Top providers for 2025–2026 (based on affordability, service, and broker feedback):

- State Compensation Insurance Fund (SCIF): Reliable for all industries, excellent for startups/high-risk.

- The Hartford: Strong digital tools, pharmacy network.

- NEXT Insurance: Affordable for small/remote-heavy businesses (starts ~$7/month).

- Preferred Employers Insurance: Specialty focus, direct MPN for faster care.

- Employers or Travelers: Good for multi-state.

Compare via WCIRB’s tools or licensed brokers. Look for MPN access (Medical Provider Networks) to control costs.

For broader coverage, explore general business insurance options or top business insurance companies.

Best Practices for Employers with Remote Teams

To minimize risks and premiums:

- Remote Work Policy: Define hours, approved workspaces, ergonomic standards.

- Safety Training: Virtual ergonomics sessions; reimburse chairs/monitors.

- Incident Reporting Protocol: Clear channels for immediate reporting.

- Return-to-Work Program: Modified duties for faster recovery.

- Annual Audits: Track classification accuracy.

If professional risks overlap (e.g., errors in advice), consider professional liability insurance.

FAQs About Workers Compensation Insurance

1. Do I need workers’ comp if all my employees are remote and out-of-state? Not necessarily California-specific coverage, but yes—coverage in the state where they reside/work. Consult a broker for multi-state compliance to avoid gaps.

2. What if a remote employee gets injured during a lunch break at home? Typically not covered, as it’s personal deviation. But if fetching work-related items (e.g., printing during break), it might qualify. Documentation is key.

3. How has remote work affected premiums in California? Overall lower physical risks, but rising ergonomic/mental health claims. Rates proposed up 11.2% in 2025 due to medical inflation and cumulative trauma.

Extra tip: Regular virtual check-ins can prevent claims—promote stretching breaks!

Conclusion

Navigating workers compensation insurance for remote employees in California boils down to one truth: Location doesn’t eliminate responsibility. California’s system prioritizes worker protection while shielding employers from lawsuits—making proper coverage a smart investment in your team’s well-being and your business’s future.

Stay compliant, foster safe remote environments, and partner with reputable providers. Test different payroll scenarios with quotes today, and explore related protections like general business insurance. Your distributed team deserves it—and so does your peace of mind.