Workers Compensation Rates for Independent Contractors

Understanding Workers Compensation Rates for Independent Contractors

Imagine you’re a freelance electrician in Texas, finally landing a big subcontracting gig on a new commercial building. You’re excited—until the general contractor asks for proof of workers’ compensation insurance. Without it, the job goes to someone else. This scenario plays out daily for thousands of independent contractors across the USA. Workers compensation rates for independent contractors can feel like a confusing barrier, especially since most solo operators aren’t legally required to carry coverage for themselves. But understanding these rates—and when you might need to pay them—can open doors to bigger opportunities and provide crucial protection.

In this comprehensive guide, we’ll break down everything you need to know about workers’ compensation for independent contractors, including how rates are calculated, state variations, and practical ways to manage costs. Whether you’re a sole proprietor, 1099 worker, or freelancer, this information will help you navigate requirements confidently and avoid costly surprises.

What Is Workers’ Compensation Insurance?

Workers’ compensation insurance, often called workers’ comp, is a state-regulated system that provides benefits to workers injured or ill due to their job. It covers medical expenses, lost wages, rehabilitation, and even death benefits—no fault required.

For traditional employees, employers must provide this coverage in nearly every state. But independent contractors—self-employed individuals who control their work methods and often serve multiple clients—are typically classified separately. This distinction means most independent contractors are exempt from mandatory coverage for themselves.

However, exemptions aren’t universal. Some states require coverage in high-risk industries like construction, and many clients (especially general contractors) demand proof of insurance before hiring subs.

Key Differences: Employees vs. Independent Contractors

To qualify as an independent contractor (and potentially exempt from workers’ comp mandates):

- You control how, when, and where you perform the work.

- You provide your own tools and equipment.

- You can work for multiple clients.

- You’re paid by project or invoice, not hourly/salary.

- You handle your own taxes (1099 form).

Misclassification is common and risky—if a court or state agency deems you an employee, the hiring company could owe back premiums, penalties, and benefits.

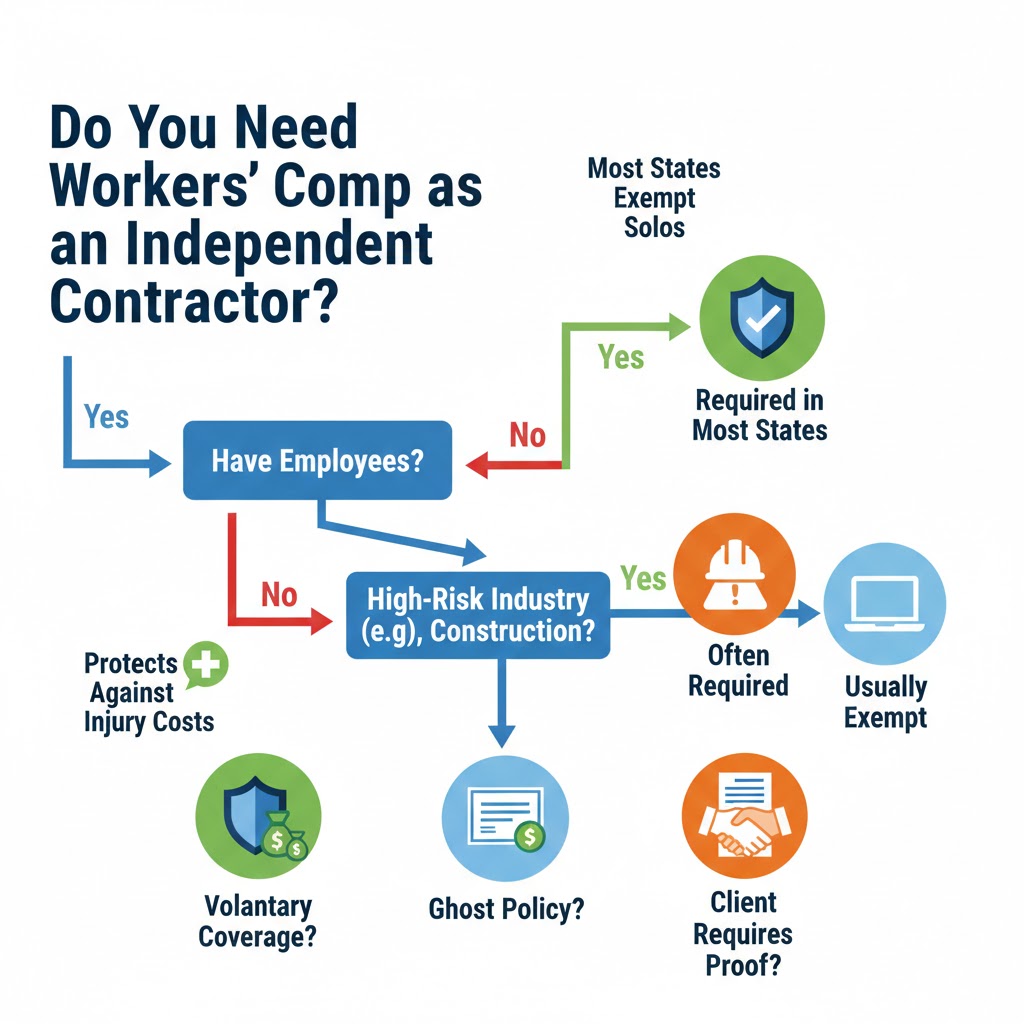

Do Independent Contractors Need Workers’ Compensation?

The short answer: Usually no, but it depends on your state, industry, and clients.

- Most states exempt sole proprietors, partners, and LLC members with no employees from mandatory workers’ comp.

- Exceptions exist: Construction trades in states like California (phasing in requirements by 2026), New York, and Colorado often require coverage even for solo operators.

- Voluntary coverage is available in many states, allowing independent contractors to buy policies for personal protection.

- Client requirements: Even if not mandated by law, general contractors frequently require subs to carry workers’ comp to avoid liability if you’re injured on-site.

Without coverage, a work-related injury could wipe out your savings—health insurance often excludes job-related incidents.

For broader business protection, check out resources like general business insurance options or state-specific rules.

How Workers Compensation Premiums Are Calculated

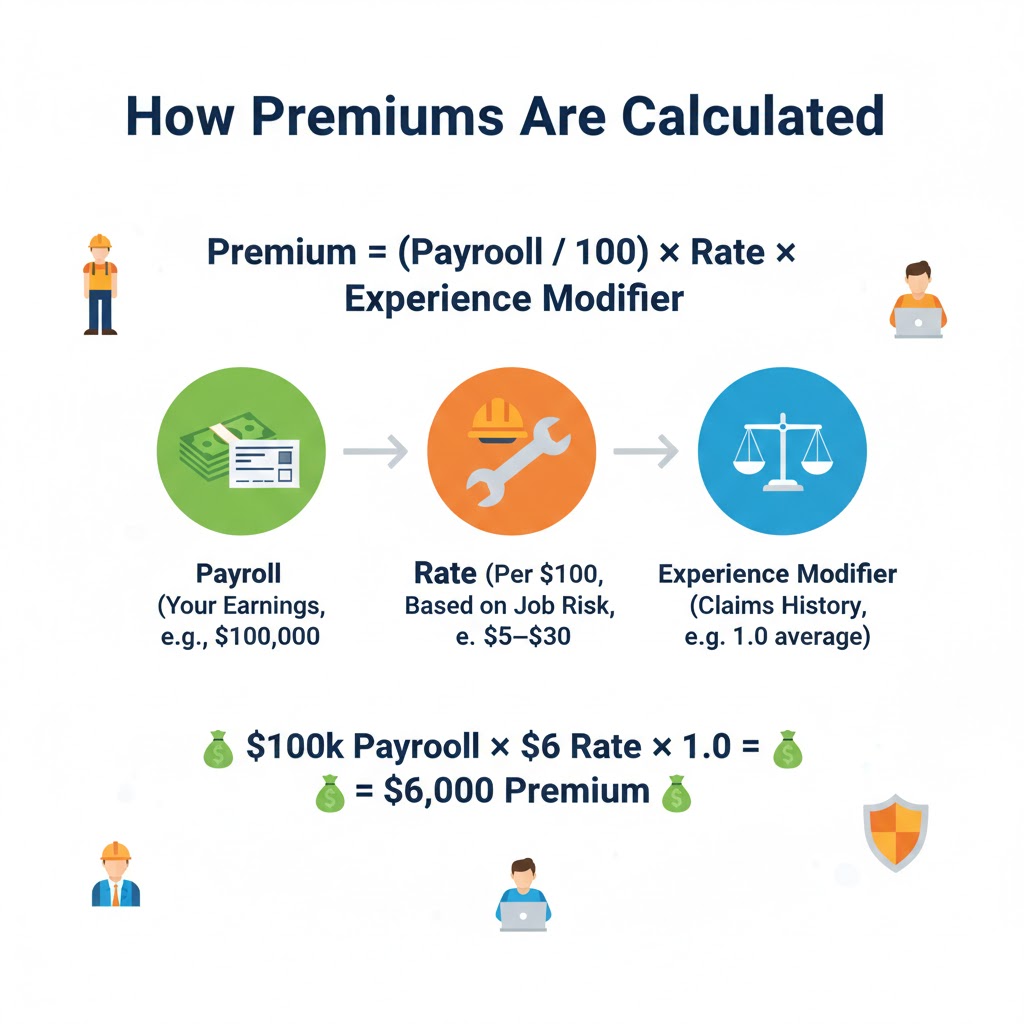

Workers’ comp rates aren’t one-size-fits-all. Premiums are based on risk, payroll, and historical data. The core formula is straightforward:

Premium = (Payroll / 100) × Rate × Experience Modifier

Here’s a breakdown:

- Class Code: Every job type has a four-digit NCCI (National Council on Compensation Insurance) code reflecting risk level. Low-risk clerical work might be $0.20–$0.50 per $100 of payroll; high-risk roofing can exceed $20–$30.

- Rate: Approved by state bureaus (often NCCI-guided). Expressed as dollars per $100 of payroll.

- Payroll: For independent contractors buying voluntary coverage, this is your assumed or reported earnings (often owner draw or gross income).

- Experience Modifier (E-Mod): A factor based on your claims history. 1.0 is average; below 1.0 lowers premiums, above raises them. New contractors start at 1.0.

Additional adjustments include audits (to verify payroll) and discounts for safety programs.

Common Class Codes and Sample Rates for Independent Contractors

| Job Type | NCCI Class Code | Typical Rate per $100 Payroll (2025–2026 Avg.) | Example Annual Premium ($100k Payroll) |

|---|---|---|---|

| Clerical/Office (e.g., consultant) | 8810 | $0.20–$0.50 | $200–$500 |

| Carpentry | 5645 | $5–$10 | $5,000–$10,000 |

| Electrical Wiring | 5190 | $3–$7 | $3,000–$7,000 |

| Plumbing | 5183 | $4–$8 | $4,000–$8,000 |

| Roofing | 5551 | $20–$30+ | $20,000–$30,000+ |

| Landscaping | 9102 | $6–$12 | $6,000–$12,000 |

Rates vary by state—California and New York tend higher; Texas and Florida lower.

Step-by-Step Examples: Calculating Rates for Independent Contractors

Let’s apply the formula to real scenarios. Encourage testing different payrolls and states for your situation.

Example 1: Low-Risk Freelance Consultant (Voluntary Coverage)

- State: Texas (low rates, voluntary optional)

- Class Code: 8810 (Clerical)

- Rate: $0.30 per $100

- Assumed Payroll: $80,000 (your annual earnings)

- E-Mod: 1.0 (no claims)

Calculation: (80,000 / 100) × 0.30 × 1.0 = 800 × 0.30 = $240 annual premium

This affordable rate protects against lost income if injured while consulting remotely.

Example 2: Solo Plumber in California (Mandatory for Licensed Contractors)

- Class Code: 5183 (Plumbing)

- Rate: $6.50 per $100

- Payroll: $120,000

- E-Mod: 0.90 (good safety record)

Calculation: (120,000 / 100) × 6.50 × 0.90 = 1,200 × 6.50 × 0.90 = $7,020 annual premium

Higher due to risk and state mandates. Learn more about workers’ compensation for remote employees in California.

Example 3: Construction Subcontractor with Ghost Policy

Many solo contractors opt for “ghost policies”—minimum-premium policies excluding the owner but providing a certificate of insurance.

- No real payroll (owner excluded)

- Minimum Premium: $500–$1,500 (varies by state/carrier)

- Provides COI for clients without full coverage cost

Ideal for bidding jobs requiring proof but no personal protection needed.

Try varying your estimated payroll—higher earnings mean higher premiums, but accurate reporting avoids audit surprises.

State Variations in Workers Comp Rates and Requirements

Rates fluctuate annually. Here’s a snapshot of average monthly costs for small/self-employed policies:

- Lowest: Texas, Florida, Georgia (~$45–$55/month)

- Highest: Alabama, California, New York (~$80–$120/month)

- National Average: ~$45–$70/month for voluntary solo coverage

Construction states often mandate coverage; office-based freelancers rarely do.

Ghost Policies: A Popular Option for Independent Contractors

A workers’ comp ghost policy is a low-cost policy for no-employee businesses. It issues a certificate but excludes the owner—perfect for proving compliance without paying full rates.

- Cost: Often $500–$900/year minimum

- Pros: Wins contracts, satisfies clients

- Cons: No actual injury protection

- Availability: Legal in most states (not California for certain trades)

Great for 1099 workers in competitive bidding.

Why Consider Coverage Even If Exempt?

- Protects your income if injured.

- Builds trust with clients.

- Avoids misclassification lawsuits.

- Pairs well with other protections like general liability for small LLCs in Florida.

FAQs About Workers Compensation Rates for Independent Contractors

1. Are independent contractors required to have workers’ comp?

No in most states if you have no employees, but construction trades and client contracts often require it. Check your state laws.

2. How much does workers’ comp cost for a solo independent contractor?

$240–$1,500+ annually for voluntary/minimum policies; higher ($5,000+) for high-risk trades with full coverage.

3. What is a ghost policy, and is it worth it?

It’s a no-coverage certificate policy (~$500–$900/year) to meet client proof requirements. Worth it for landing jobs without full premiums.

Extra Tip: Always get certificates from subs if you’re a general contractor—uninsured subs can spike your rates.

Conclusion

Navigating workers compensation rates for independent contractors doesn’t have to be overwhelming. While most solo operators are exempt from mandates, understanding rates, class codes, and options like voluntary coverage or ghost policies empowers you to protect your business and win more work.

Key takeaways: Rates are payroll-based and risk-driven; state rules vary; voluntary or ghost policies offer flexibility. Test scenarios with different payrolls and jobs to estimate your costs accurately.

Ready to explore options? Dive into related guides like workers’ comp exemptions for family-owned businesses or professional liability for freelance consultants in Texas. Protecting yourself today ensures your independent career thrives tomorrow.